So, you're here because you want to know everything about Google stock price, right? Well, buckle up, my friend, because we're diving headfirst into the world of tech stocks, market trends, and investment opportunities. Whether you're a seasoned investor or just someone curious about how big tech companies like Google impact the stock market, this article’s got you covered. From the basics to the nitty-gritty details, we'll break it all down so you can make informed decisions. Let's get started, shall we?

Investing in stocks is like playing a high-stakes game of poker, except instead of cards, you're dealing with numbers, charts, and financial reports. And when it comes to tech giants like Google, the stakes are even higher. Google stock price isn't just a number on a screen; it's a reflection of the company's performance, market sentiment, and future potential. Understanding it can be the difference between a smart investment and a costly mistake.

But before we dive too deep, let's clarify something: this isn't just another article filled with jargon and graphs. We're keeping it real, breaking things down in a way that makes sense, even if you're new to the stock market game. So, whether you're here to learn, invest, or just satisfy your curiosity, you're in the right place. Let's roll!

Understanding Google Stock Price

What Exactly Is Google Stock Price?

Alright, let's start with the basics. Google stock price refers to the value of a single share of Alphabet Inc., the parent company of Google. Yep, you heard that right—Google rebranded itself as Alphabet back in 2015, but most people still refer to it as Google. The stock is traded under the ticker symbol GOOGL for Class A shares and GOOG for Class C shares. Each share represents a small piece of ownership in the company, and its price fluctuates based on supply and demand, company performance, and market conditions.

Now, here's the kicker: Google stock isn't cheap. In fact, it's one of the priciest stocks out there. As of recent data, a single share of GOOGL can cost you anywhere from $900 to over $1,200, depending on market conditions. That's a lot of dough, but it also reflects the company's massive market cap and dominance in the tech industry.

Factors Influencing Google Stock Price

So, what makes Google stock price go up or down? Well, there are several factors at play:

- Company Performance: Google's quarterly earnings reports, revenue growth, and profit margins play a huge role. If the company exceeds expectations, the stock price usually rises. On the flip side, if it misses targets, investors might start selling off their shares, causing the price to drop.

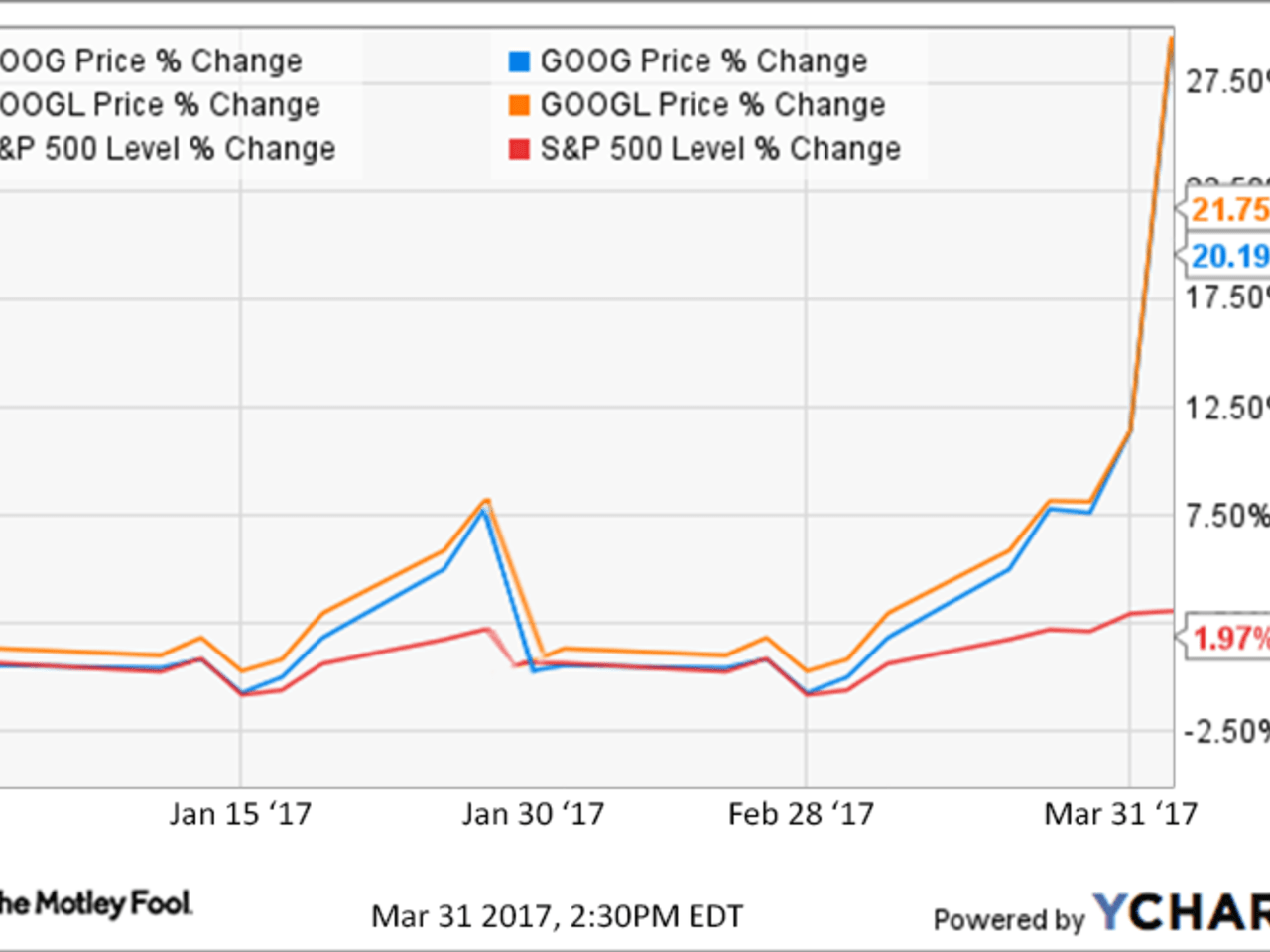

- Market Trends: The tech sector as a whole can influence Google's stock price. If investors are bullish on tech stocks, Google benefits. Conversely, if there's a tech sell-off, it could hurt the stock.

- Global Events: Economic downturns, geopolitical tensions, and even natural disasters can impact investor sentiment and, by extension, stock prices.

- Innovation and Competition: Google's ability to innovate and stay ahead of competitors like Apple, Amazon, and Microsoft is crucial. Any major product launch, acquisition, or setback can sway the stock price.

It's like a giant game of chess, where every move by the company and its competitors can shift the balance of power—and the stock price along with it.

Historical Performance of Google Stock

A Look Back at Google's Stock Journey

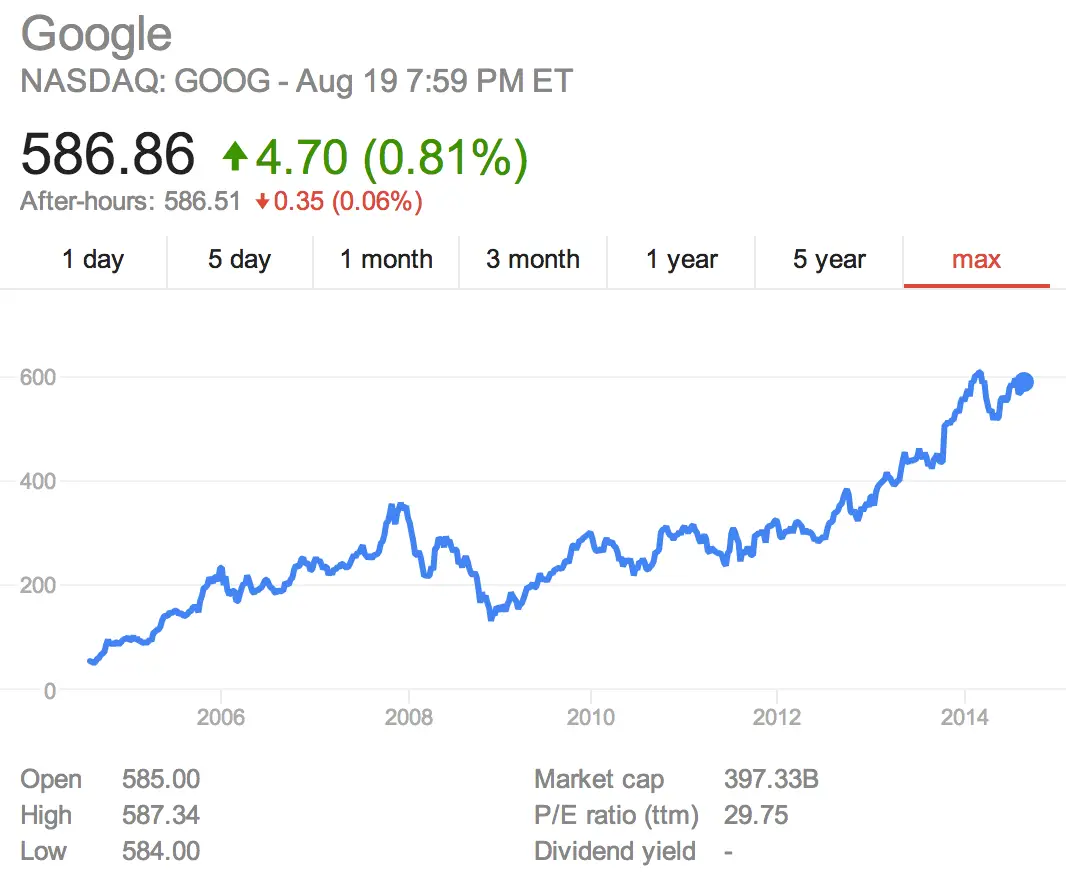

When Google first went public in 2004, the initial public offering (IPO) price was $85 per share. Fast forward to today, and those shares have multiplied in value, making early investors extremely wealthy. Over the years, Google's stock has seen its fair share of ups and downs, but the overall trend has been upward.

One of the most significant moments in Google's stock history was the stock split in 2014, when the company introduced Class C shares (GOOG). This move was designed to give shareholders voting rights while maintaining control within the founding team. Since then, the stock has continued to grow, albeit with some volatility along the way.

Key Milestones in Google Stock History

Here are a few key moments that have shaped Google's stock price over the years:

- 2004 IPO: Google goes public with an IPO price of $85 per share.

- 2014 Stock Split: Introduction of Class C shares (GOOG).

- 2015 Rebranding: Google becomes Alphabet Inc., restructuring its business operations.

- 2020 Pandemic: Initial dip in stock price due to economic uncertainty, followed by a rapid recovery as digital advertising surged.

- 2023 Innovations: Continued focus on AI, cloud computing, and other cutting-edge technologies drives investor confidence.

Each of these milestones has contributed to the stock's growth and evolution, making it one of the most watched stocks in the market today.

Why Should You Care About Google Stock Price?

The Importance of Google in the Stock Market

Google isn't just any company; it's a tech behemoth that dominates several industries, from search engines to online advertising, cloud computing, and artificial intelligence. Its influence extends far beyond the stock market, shaping how people interact with technology and information. For investors, keeping an eye on Google stock price is essential because:

- It's a bellwether for the tech sector, reflecting broader market trends.

- Its innovations often set the pace for industry advancements.

- Its financial performance provides insights into consumer behavior and digital advertising trends.

Whether you're a long-term investor or a day trader, understanding Google stock price can help you make smarter decisions in the ever-changing world of finance.

Investing in Google Stock

Is Google Stock a Good Investment?

Now, let's talk about the elephant in the room: should you invest in Google stock? The answer, like most things in finance, depends on your goals, risk tolerance, and investment horizon. Here are a few reasons why Google might be worth considering:

- Strong Financial Performance: Google consistently posts impressive revenue and profit numbers, driven by its dominant position in online advertising.

- Innovative Pipeline: The company is heavily invested in AI, cloud computing, and other growth areas, positioning it well for the future.

- Global Reach: With billions of users worldwide, Google's products and services have a massive impact on consumer behavior and digital trends.

Of course, no investment is without risk. Google faces challenges like regulatory scrutiny, competition, and economic uncertainties. But for many investors, the potential rewards outweigh the risks.

Tips for Investing in Google Stock

If you're thinking about jumping into the Google stock game, here are a few tips to keep in mind:

- Do Your Research: Understand the company's financials, growth prospects, and competitive landscape.

- Set Realistic Expectations: Don't expect overnight riches; investing is a long-term game.

- Stay Informed: Keep up with market news, earnings reports, and industry trends to make informed decisions.

Remember, investing is a personal decision, and what works for one person might not work for another. Always consult with a financial advisor if you're unsure.

Google Stock Price Analysis

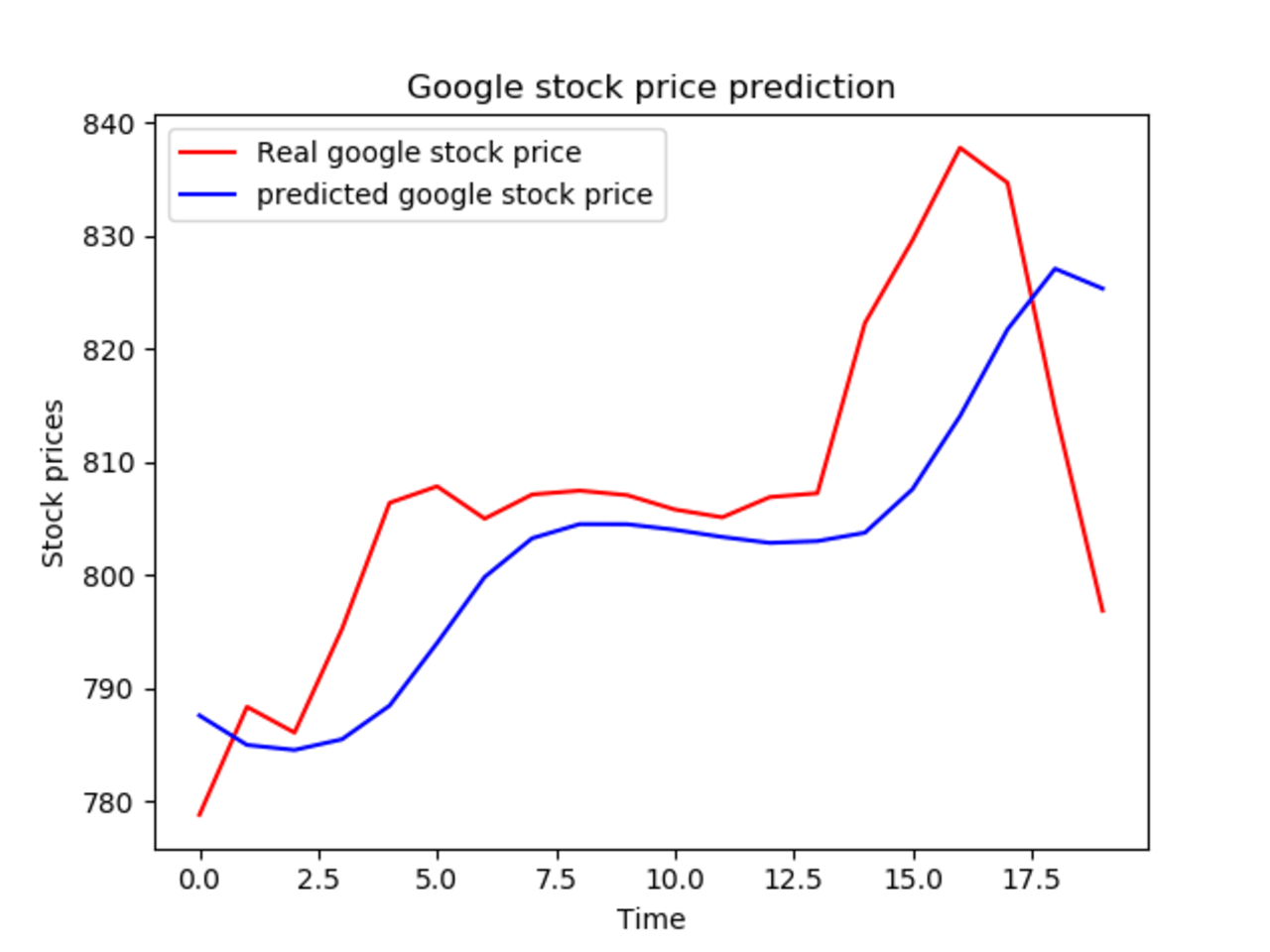

Technical vs. Fundamental Analysis

When it comes to analyzing Google stock price, there are two main approaches: technical analysis and fundamental analysis. Technical analysis focuses on historical price movements and chart patterns, while fundamental analysis looks at the company's financial health, industry position, and growth potential.

Both methods have their merits, and many investors use a combination of the two to make informed decisions. For example, technical analysts might look at moving averages and support/resistance levels to predict short-term price movements, while fundamental analysts might examine Google's earnings reports and cash flow statements to assess long-term value.

Tools for Analyzing Google Stock Price

There are plenty of tools and platforms available to help you analyze Google stock price. Some popular options include:

- Yahoo Finance: Offers real-time stock quotes, news, and analysis.

- Google Finance: Provides detailed financial data and charts.

- TradingView: A powerful platform for technical analysis with customizable charts and indicators.

No matter which tool you choose, the key is to use it consistently and in combination with other sources of information to get a well-rounded view of the market.

Future Outlook for Google Stock Price

Trends Shaping Google's Future

Looking ahead, several trends are likely to influence Google stock price in the coming years:

- AI Revolution: Google's leadership in artificial intelligence could drive significant growth, especially in areas like autonomous vehicles and healthcare.

- Cloud Expansion: The company's push into cloud computing is paying off, with Google Cloud becoming a major revenue driver.

- Regulatory Challenges: Ongoing antitrust investigations and potential regulatory changes could pose risks to the company's business model.

While the future is always uncertain, Google's track record of innovation and adaptability gives many investors confidence in its long-term prospects.

Conclusion

Google stock price is more than just a number; it's a reflection of one of the most influential companies in the world. From its humble beginnings as a search engine to its current status as a tech giant, Google has consistently proven its ability to innovate and grow. Whether you're an investor, a tech enthusiast, or just someone curious about the stock market, understanding Google stock price is a valuable skill.

So, what's next? If you've found this article helpful, don't hesitate to share it with your friends or leave a comment below. And if you're ready to dive deeper into the world of investing, be sure to check out our other articles on finance and technology. Remember, knowledge is power, and the more you know, the better equipped you'll be to make smart decisions in the stock market game.

Table of Contents

- Understanding Google Stock Price

- Factors Influencing Google Stock Price

- Historical Performance of Google Stock

- Key Milestones in Google Stock History

- Why Should You Care About Google Stock Price?

- Investing in Google Stock

- Tips for Investing in Google Stock

- Google Stock Price Analysis

- Tools for Analyzing Google Stock Price

- Future Outlook for Google Stock Price