Listen up, folks. If you're one of the millions who didn't claim your $1,400 stimulus check back in 2021, the clock is ticking. The IRS has set a hard deadline for folks to file their returns and claim that money. And trust me, you don’t want to miss out on this opportunity. It’s like free cash waiting for you, and all you gotta do is take a few simple steps.

Now, I know what you're thinking—“Why should I care about something from 2021?” Well, here’s the deal: the government sent out these stimulus checks to help people during the pandemic. But some folks either missed it or didn’t know they were eligible. If you fall into that category, now’s the time to act. The deadline is almost here, and once it passes, there’s no turning back.

This isn’t just about getting a little extra cash; it’s about securing what’s rightfully yours. The government isn’t in the habit of handing out free money, so when they do, you better make sure you grab it. Let me break it down for you, step by step, so you don’t miss out on this golden opportunity.

Alright, before we dive deep into the nitty-gritty, let’s talk about why this matters. In 2021, the U.S. government passed the American Rescue Plan, which included a third round of stimulus checks worth up to $1,400 per person. But not everyone got theirs automatically. Some people were left out because they didn’t file taxes or didn’t meet certain criteria at the time. Now, the IRS is giving everyone a second chance—but only if you act fast.

So, buckle up, because we’re about to walk you through everything you need to know about claiming your $1,400 stimulus check before it’s too late. We’ll cover the deadline, who’s eligible, how to file, and what happens if you miss it. By the end of this, you’ll be armed with all the info you need to get that cash in your pocket.

Table of Contents

- Who Is Eligible for the $1,400 Stimulus Check?

- Why Did Some People Miss Out?

- What’s the Deadline for Filing?

- How Do You Claim the Missing Payment?

- Steps to File Recovery Rebate Credit

- Common Mistakes to Avoid

- What Happens If You Miss the Deadline?

- Important Documents You’ll Need

- Tips for Filing Your Taxes Quickly

- Final Thoughts: Don’t Let That Money Slip Away

Who Is Eligible for the $1,400 Stimulus Check?

Let’s start with the basics. Who exactly qualifies for this $1,400 stimulus check? To put it simply, most Americans were eligible if they met certain income requirements. Here’s the breakdown:

- Single filers with an adjusted gross income (AGI) of less than $75,000.

- Head of household filers with an AGI under $112,500.

- Married couples filing jointly with an AGI below $150,000.

Now, if your income was slightly above those limits, you might still qualify for a reduced payment. But here’s the kicker: if you didn’t file taxes in 2020 or 2021, or if you didn’t use the Non-Filers tool on the IRS website, there’s a good chance you didn’t get your check. And that’s where the Recovery Rebate Credit comes in.

But hey, don’t panic yet. There’s still time to claim that money, as long as you act fast. Let’s move on to the next section to figure out why some people missed out.

Why Did Some People Miss Out?

There are a few reasons why some folks didn’t receive their stimulus checks back in 2021. Here are the top ones:

- They didn’t file taxes in 2020 or 2021.

- They were claimed as dependents on someone else’s tax return.

- They didn’t use the Non-Filers tool to provide their information to the IRS.

- They moved and didn’t update their address with the IRS.

Let me paint you a picture. Imagine you’re a college student who didn’t work in 2020 and didn’t file taxes. Or maybe you’re a senior citizen living on Social Security benefits. In both cases, the IRS might not have had your info, so they couldn’t send you the check. But guess what? You can still claim it now by filing your taxes and requesting the Recovery Rebate Credit.

Dependents and the $1,400 Check

One important thing to note is that dependents also qualified for the $1,400 payment. This includes children, college students, and even elderly relatives. If you claimed dependents on your tax return, you could get an additional $1,400 for each one. So, if you had three kids, that’s an extra $4,200 right there!

What’s the Deadline for Filing?

Here’s the part you’ve been waiting for: the deadline. The IRS has set October 16, 2023, as the final date to file your 2021 tax return and claim the Recovery Rebate Credit. That’s right, folks—just a few weeks left to get your act together.

If you miss this deadline, you won’t be able to claim the $1,400 stimulus check. And trust me, that’s money you don’t want to leave on the table. So, mark your calendar, set a reminder on your phone, and get ready to file those taxes.

How Do You Claim the Missing Payment?

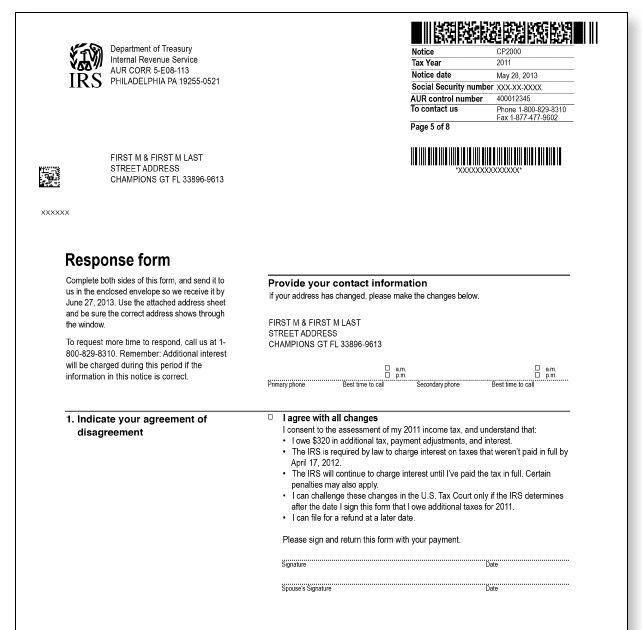

Claiming the missing stimulus payment is actually pretty straightforward. All you need to do is file your 2021 tax return and include the Recovery Rebate Credit on your Form 1040. If you already filed your 2021 taxes but didn’t include the credit, you can file an amended return to claim it.

Here’s a quick rundown of the steps:

- Gather all your tax documents, including W-2s, 1099s, and any other income statements.

- Fill out Form 1040 and include the Recovery Rebate Credit.

- Submit your tax return electronically or by mail.

- Wait for the IRS to process your return and issue your refund.

It might sound like a lot, but with the right tools and resources, it’s totally doable. Plus, there are tons of free tax filing options available for low-income individuals and families.

Using Free Tax Software

If you’re worried about the cost of filing taxes, don’t sweat it. The IRS offers a program called Free File, which provides free tax preparation and filing services for eligible taxpayers. All you need is an email address and access to the internet.

There are also organizations like Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) that offer free tax help to qualifying individuals. So, no matter your situation, there’s a way to get your taxes done without breaking the bank.

Steps to File Recovery Rebate Credit

Now that you know how to claim the missing payment, let’s go over the specific steps to file the Recovery Rebate Credit. Here’s what you need to do:

- Download Form 1040 from the IRS website.

- Fill out the form, including your personal information and income details.

- On line 30 of Form 1040, enter the amount of the Recovery Rebate Credit you’re claiming.

- Attach any necessary documents, such as proof of income or dependents.

- Submit your tax return electronically or by mail.

It’s important to double-check your work before submitting your return. Even a small mistake can cause delays or result in your claim being denied. So, take your time and make sure everything is accurate.

Common Mistakes to Avoid

When it comes to filing taxes, mistakes happen. But some errors can cost you big time. Here are a few common mistakes to avoid when claiming the Recovery Rebate Credit:

- Not reporting all sources of income.

- Entering the wrong Social Security number or name.

- Forgetting to sign and date your tax return.

- Missing the deadline to file.

Trust me, these might seem like small things, but they can cause major headaches. So, take your time and review your return carefully before submitting it.

Double-Check Your Dependent Information

One of the biggest mistakes people make is forgetting to include their dependents on their tax return. Remember, each dependent qualifies for an additional $1,400. So, if you have kids or elderly relatives you support, make sure to include them on your return. It could mean the difference between a small refund and a big one.

What Happens If You Miss the Deadline?

Okay, let’s talk about the elephant in the room. What happens if you miss the October 16, 2023, deadline? Unfortunately, if you don’t file your 2021 tax return by that date, you won’t be able to claim the Recovery Rebate Credit. That means you’ll lose out on the $1,400 stimulus check—and potentially thousands more if you have dependents.

But here’s the thing: missing the deadline doesn’t mean you’re completely out of luck. You can still file your taxes and claim other deductions and credits you might be eligible for. It just means you won’t get the stimulus money. So, while it’s not the end of the world, it’s definitely something you want to avoid.

Important Documents You’ll Need

Before you start filing your taxes, make sure you have all the necessary documents. Here’s a list of what you’ll need:

- Form W-2 from your employer.

- Form 1099 for any freelance or gig work you did.

- Proof of dependents, such as birth certificates or Social Security cards.

- Bank account information for direct deposit.

Having all your documents in order will make the filing process much smoother. Plus, it’ll help you avoid any unnecessary delays or errors.

Tips for Filing Your Taxes Quickly

Time is of the essence, so here are a few tips to help you file your taxes quickly and efficiently:

- Use free tax software like TurboTax or TaxSlayer.

- Gather all your documents ahead of time.

- File electronically for faster processing.

- Double-check your work before submitting.

By following these tips, you’ll be well on your way to claiming that $1,400 stimulus check before the deadline. And who knows? You might even get your refund faster than you expected.

Final Thoughts: Don’t Let That Money Slip Away

Alright, folks, here’s the bottom line: the deadline for claiming your $1,400 stimulus check is fast approaching. If you haven’t filed your 2021 tax return yet, now’s the time to act. Don’t let that money slip through your fingers. It’s yours by law, and you deserve it.

Remember, the Recovery Rebate Credit isn’t just about getting a little extra cash. It’s about securing what’s rightfully yours and ensuring you’re taken care of during these uncertain times. So, gather your documents, file your taxes, and claim that money before it’s too late.

And hey, once you’ve claimed your stimulus check, don’t forget to share this article with your friends and family. You never know who else might need the info.