Listen up, folks! If you’ve been wondering whether you’re eligible for that sweet $1,400 stimulus check from the IRS, this article’s got your back. With the ongoing economic challenges, the government’s trying its best to help folks stay afloat. But here’s the deal—there’s a process, and you gotta know what’s up to see if you qualify. Stick around, and we’ll break it down step by step!

Let’s face it, life’s been tough for a lot of people lately. Whether it’s paying the rent, keeping the lights on, or just trying to make ends meet, the financial strain has been real. That’s why the government decided to step in and offer some relief in the form of stimulus checks. But hey, not everyone gets one, so it’s important to know if you’re eligible.

This article is all about helping you figure out if you qualify for that $1,400 stimulus check. We’ll dive deep into the details, explain the rules, and give you practical tips to check your eligibility. By the end of this, you’ll have all the info you need to claim what’s rightfully yours. So, let’s get started!

Understanding the Basics of the $1,400 Stimulus Check

First things first, let’s talk about what this stimulus check is all about. It’s basically a payment from the government to help individuals and families cope with financial hardships caused by the pandemic. The $1,400 amount is part of a larger relief package aimed at boosting the economy and supporting those who need it most.

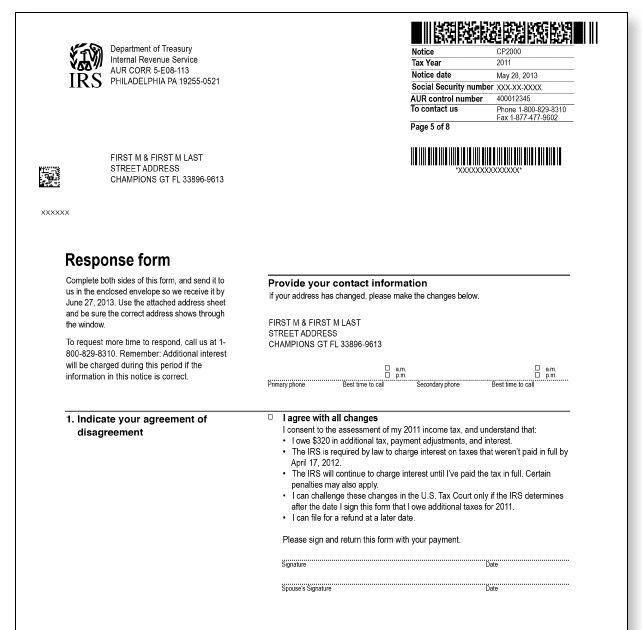

The IRS is in charge of distributing these payments, and they base eligibility on factors like income, tax filings, and dependent status. If you’ve filed your taxes recently, chances are the IRS already has your info and might send you the check automatically. But don’t worry if you haven’t gotten yours yet—we’ll cover how to check your status later.

Who’s Eligible for the Stimulus Check?

Now, here’s where things get interesting. Not everyone qualifies for the $1,400 stimulus check, but a lot of people do. Generally speaking, individuals earning less than $75,000 annually and married couples earning less than $150,000 are eligible. But there are some nuances, so let’s break it down further.

Key Eligibility Criteria

- Individuals with an adjusted gross income (AGI) below $75,000.

- Married couples filing jointly with an AGI below $150,000.

- Heads of households with an AGI below $112,500.

- Dependents, including adult dependents, may also qualify for additional payments.

It’s worth noting that the payment amount phases out for those earning above these thresholds. So, if you’re close to the limit, it’s a good idea to double-check your eligibility.

How to Check If You Qualify for the Stimulus Check

Alright, let’s get practical. Checking your eligibility for the $1,400 stimulus check is easier than you might think. The IRS has set up a system to make it as straightforward as possible. Here’s what you need to do:

Step 1: Gather Your Tax Documents

First off, you’ll want to have your most recent tax return handy. This will give you all the info you need about your income, dependents, and filing status. If you haven’t filed your taxes for the current year yet, don’t panic. The IRS will use your previous year’s return to determine eligibility.

Step 2: Use the IRS Get My Payment Tool

The IRS has a handy tool called “Get My Payment” that lets you check the status of your stimulus check. All you need is your Social Security number, date of birth, and filing information. This tool will tell you if you’re eligible, how much you’ll receive, and when to expect your payment.

What If You Haven’t Received Your Stimulus Check?

There could be several reasons why you haven’t received your $1,400 stimulus check yet. Maybe the IRS doesn’t have your updated info, or perhaps there was a delay in processing. Whatever the case, here’s what you can do:

Tips for Tracking Your Payment

- Check the IRS website regularly for updates.

- Verify your banking info to ensure direct deposits are correct.

- Contact the IRS if you suspect an error or delay.

Remember, patience is key. The IRS processes millions of payments, so it might take a little while for yours to show up. But if it’s been a while and you still haven’t received anything, don’t hesitate to reach out for assistance.

Common Questions About the Stimulus Check

Let’s tackle some of the most frequently asked questions about the $1,400 stimulus check. These answers should clear up any confusion and help you navigate the process more smoothly.

Q: Can I get a stimulus check if I didn’t file taxes?

Yes, you can! The IRS offers a Non-Filers tool to help those who don’t typically file taxes claim their stimulus payments. Make sure to use this resource if you qualify but haven’t filed in the past.

Q: What happens if I owe back taxes or have unpaid debts?

If you owe back taxes or have certain types of unpaid debts, your stimulus payment might be reduced or offset. However, the IRS has guidelines in place to protect some payments, so it’s worth checking your specific situation.

How the Stimulus Check Impacts Your Finances

Receiving a stimulus check can be a game-changer for your finances. Whether you’re planning to pay off debt, save for the future, or cover immediate expenses, this extra cash can make a big difference. Here are a few tips on how to make the most of your payment:

Wise Ways to Use Your Stimulus Check

- Prioritize essential expenses like rent, utilities, and groceries.

- Pay down high-interest debt to save money in the long run.

- Set aside a portion for emergencies to build a safety net.

Remember, the goal is to use this money wisely and make it work for you. Think about your financial goals and how the stimulus check can help you achieve them.

Staying Informed About Future Stimulus Payments

As the economic landscape continues to evolve, there’s always a possibility of more stimulus payments in the future. Staying informed is key to ensuring you don’t miss out on any opportunities. Here’s how you can stay up-to-date:

Resources to Follow

- IRS website for official updates and announcements.

- Financial news outlets for breaking stories and analysis.

- Social media channels for quick updates and community insights.

By keeping an eye on these resources, you’ll always be in the loop when it comes to stimulus checks and other financial assistance programs.

Conclusion: Take Action and Secure Your Stimulus Check

Alright, that’s a wrap! You now know everything you need to check if you’re eligible for that $1,400 stimulus check from the IRS. Remember, the key is to stay informed, gather your documents, and use the tools available to track your payment.

So, what’s next? Take a moment to verify your eligibility, check your status, and plan how you’ll use your stimulus check. And don’t forget to share this article with friends and family who might benefit from the info. Together, we can make sure everyone gets the support they need during these challenging times.

Got questions or feedback? Drop a comment below, and let’s keep the conversation going!

Table of Contents

- Understanding the Basics of the $1,400 Stimulus Check

- Who’s Eligible for the Stimulus Check?

- How to Check If You Qualify for the Stimulus Check

- What If You Haven’t Received Your Stimulus Check?

- Common Questions About the Stimulus Check

- How the Stimulus Check Impacts Your Finances

- Staying Informed About Future Stimulus Payments

- Conclusion: Take Action and Secure Your Stimulus Check