Alright folks, let’s cut to the chase—Fed Rate! You’ve probably heard this term floating around in financial news, business podcasts, or maybe even during your uncle’s rant at Thanksgiving dinner. But what exactly is the Fed Rate? Why does it matter so much to the economy, your wallet, and even the stock market? If you’ve ever scratched your head wondering how a tiny percentage change can ripple through the entire financial world, you’re in the right place. This article will break it all down for you, no MBA required.

Now, let’s set the stage. The Fed Rate—or Federal Funds Rate, if you want to get all fancy—is essentially the interest rate that banks charge each other for overnight loans. Yeah, banks borrow money from each other too, and the Fed Rate is the benchmark that governs these transactions. It’s like the heartbeat of the economy, dictating how easy or hard it is for businesses and consumers to access credit. When the Fed Rate goes up, borrowing becomes more expensive. When it goes down, borrowing gets cheaper. Simple, right? Well, not exactly.

Before we dive deeper, let’s talk about why this matters to you. Whether you’re a first-time homebuyer, an entrepreneur looking for a loan, or just someone trying to save up for a dream vacation, the Fed Rate has a direct impact on your financial decisions. It affects everything from mortgage rates to credit card APRs, car loans, and even your savings account interest. So buckle up, because we’re about to take a deep dive into the world of Fed Rates and why they’re such a big deal.

What Exactly is the Fed Rate?

Let’s get technical for a sec, but don’t worry, I’ll keep it light. The Fed Rate is basically the interest rate that banks charge each other when they lend money overnight. Think of it as a financial version of borrowing a cup of sugar from your neighbor, except instead of sugar, it’s cold hard cash. This rate is set by the Federal Open Market Committee (FOMC), a group within the Federal Reserve System that meets eight times a year to decide whether to raise, lower, or keep the Fed Rate the same.

Why Does the Fed Rate Exist?

Here’s the kicker: the Fed Rate isn’t just some random number plucked out of thin air. It’s a tool used by the Federal Reserve to control inflation and stabilize the economy. When the economy is overheating and prices are rising too fast, the Fed might hike the rate to cool things down. On the flip side, during a recession or economic downturn, they might lower the rate to encourage borrowing and spending. It’s like the Fed’s way of saying, “Hey, let’s not get too crazy here.”

How Does the Fed Rate Impact the Economy?

Alright, so we know what the Fed Rate is and why it exists, but how does it actually affect the economy? Let’s break it down into bite-sized chunks:

- Borrowing Costs: When the Fed Rate goes up, borrowing becomes more expensive. This means businesses might think twice before taking out loans to expand, and consumers might hesitate before buying a new house or car.

- Savings Rates: On the flip side, higher Fed Rates can mean better returns on savings accounts and certificates of deposit (CDs). So if you’re a saver, this could be good news for you.

- Stock Market: The stock market tends to react strongly to changes in the Fed Rate. A rate hike can send stocks tumbling, while a rate cut might give them a boost. Investors, traders, and analysts spend countless hours trying to predict the Fed’s next move.

- Inflation: The Fed Rate is one of the main tools used to keep inflation in check. By adjusting the rate, the Fed can influence how much prices rise or fall over time.

Real-World Examples of Fed Rate Impact

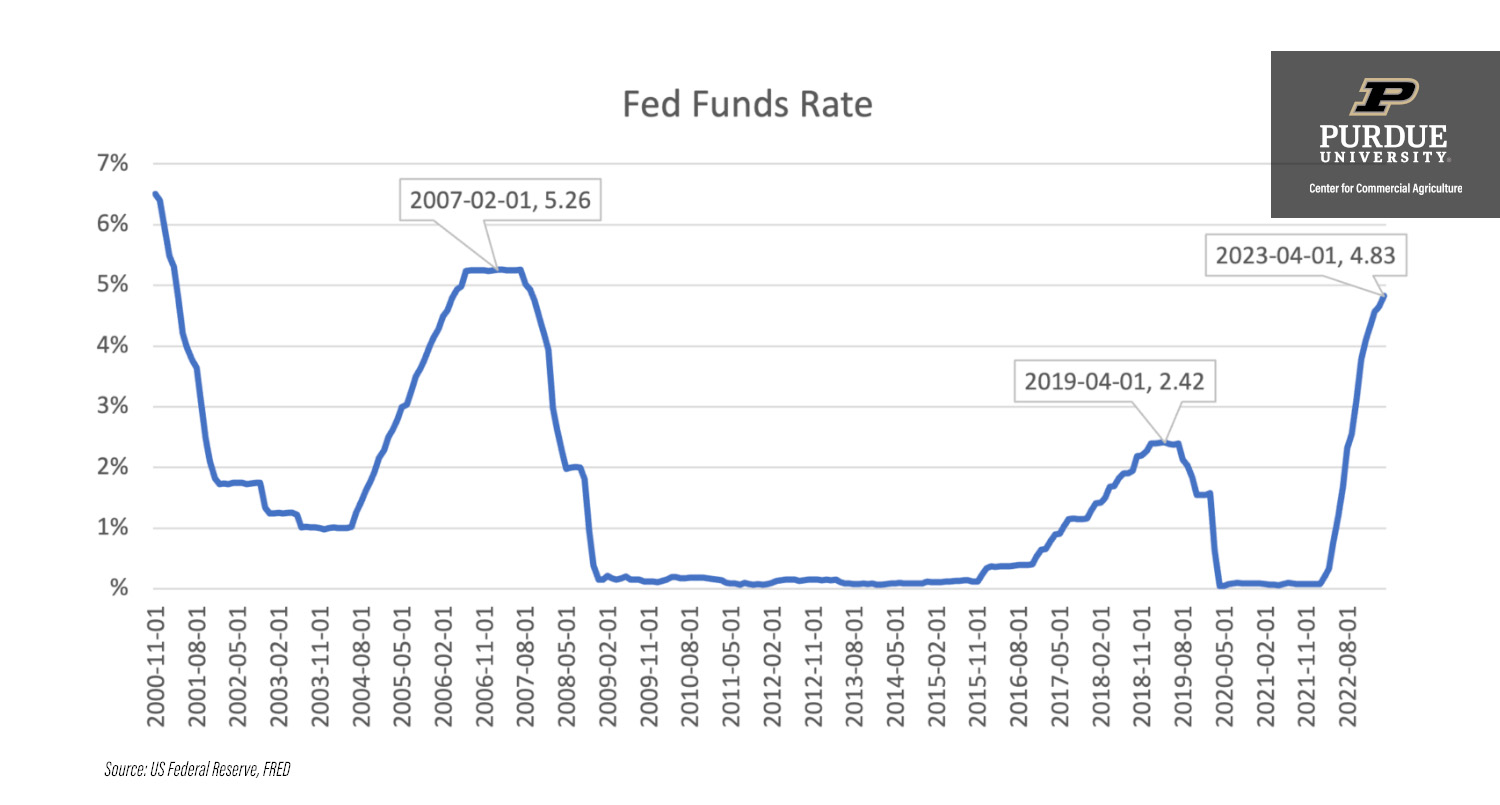

Let’s take a trip down memory lane. In 2008, during the Great Recession, the Fed slashed the rate to nearly zero to stimulate the economy. This helped businesses and consumers access credit at rock-bottom rates, which was crucial during such a turbulent time. Fast forward to 2022, when inflation was running rampant, the Fed had to hike rates aggressively to rein in rising prices. It wasn’t pretty, but sometimes tough love is necessary.

Who Sets the Fed Rate?

The Federal Open Market Committee (FOMC) is the big boss when it comes to setting the Fed Rate. This group consists of 12 members, including the seven members of the Board of Governors and five Federal Reserve Bank presidents. They meet eight times a year to discuss the state of the economy and decide on monetary policy, including the Fed Rate. It’s like a high-stakes poker game, except instead of chips, they’re playing with trillions of dollars.

How Does the FOMC Make Decisions?

The FOMC doesn’t just flip a coin to decide what to do with the Fed Rate. They analyze a ton of economic data, including employment numbers, inflation rates, GDP growth, and consumer spending. They also listen to feedback from businesses, economists, and even everyday people. It’s a complex process, but the goal is always the same: to keep the economy running smoothly.

Historical Trends in Fed Rate

Let’s take a stroll through history and see how the Fed Rate has evolved over the years:

- 1980s: The Fed Rate hit an all-time high of 20% in 1981 to combat runaway inflation. Yikes!

- 2000s: During the early 2000s, the Fed kept rates low to stimulate the housing market, which some argue contributed to the 2008 financial crisis.

- 2010s: After the Great Recession, the Fed kept rates near zero for years to help the economy recover.

- 2020s: In response to the pandemic, the Fed once again dropped rates to near zero, only to hike them sharply in 2022 to fight inflation.

Lessons Learned from History

History has taught us that the Fed Rate is a powerful tool, but it’s not without its risks. If the Fed raises rates too quickly, it can trigger a recession. If they keep rates too low for too long, it can lead to asset bubbles and inflation. It’s a delicate balancing act, and the FOMC has to tread carefully.

How Does the Fed Rate Affect You?

Let’s bring it back to you, because let’s face it, that’s what really matters, right? Here’s how the Fed Rate can impact your personal finances:

- Mortgages: If you’re in the market for a home, the Fed Rate can affect your mortgage rate. A higher Fed Rate means higher mortgage rates, which can make buying a home more expensive.

- Credit Cards: Most credit card APRs are tied to the Fed Rate. So if the Fed Rate goes up, you can expect to pay more in interest on your credit card balance.

- Savings Accounts: On the bright side, higher Fed Rates can mean better returns on your savings. So if you’ve got a chunk of cash sitting in the bank, you might see some extra interest income.

Tips for Navigating Fed Rate Changes

Here are a few tips to help you weather the storm of Fed Rate changes:

- Refinance: If you have an existing mortgage or loan, consider refinancing to lock in a lower rate before the Fed hikes rates again.

- Pay Down Debt: With interest rates likely to rise, now’s a good time to focus on paying down high-interest debt like credit cards.

- Shop Around: If you’re looking for a savings account or CD, shop around for the best rates. Some banks and credit unions offer higher returns than others.

Future Predictions for Fed Rate

So, what’s on the horizon for the Fed Rate? That’s the million-dollar question, and unfortunately, no one has a crystal ball. However, most economists agree that the Fed will continue to hike rates in the short term to combat inflation. The big question is how high they’ll go and how long they’ll stay there. Some predict rates could peak at 5% or higher before the Fed starts cutting again.

What to Watch For

Keep an eye on key economic indicators like inflation rates, employment numbers, and GDP growth. These are the metrics the Fed uses to make their decisions, so they can give you a clue about where rates might be headed. Also, pay attention to Fed Chair Jerome Powell’s speeches and press conferences. He often drops hints about the Fed’s future plans.

Conclusion: Why Fed Rate Matters

Alright folks, let’s wrap this up. The Fed Rate might seem like a dry, technical topic, but it’s one of the most important factors affecting the economy and your personal finances. Whether you’re a homeowner, a business owner, or just someone trying to make ends meet, understanding the Fed Rate can help you make smarter financial decisions.

So here’s what I want you to do: leave a comment below and let me know what you think about the Fed Rate. Are you worried about rising rates? Excited about potential savings account returns? Or maybe you’ve got a question you’d like me to answer in a future article. Whatever it is, I’d love to hear from you. And while you’re at it, why not share this article with a friend? Knowledge is power, and the more people understand the Fed Rate, the better off we all are.

Thanks for reading, and until next time, stay savvy!

Table of Contents