Alright folks, let's dive into something that might sound boring to some but trust me, it’s got more drama than your favorite Netflix series. The FOMC meeting is not just another boardroom gathering; it's where the big boys decide the fate of global economies. Imagine a room full of economists, analysts, and decision-makers, all trying to figure out how to keep the financial world from falling apart. Yeah, that's the FOMC meeting in a nutshell.

Now, before we get into the nitty-gritty, let me break this down for you. FOMC stands for Federal Open Market Committee, and it's basically the team responsible for setting monetary policy in the United States. And guess what? What they decide has ripple effects across the globe. So, if you're into stocks, forex, or just want to know why your mortgage rate might go up, you're in the right place.

Here's the deal: this meeting happens eight times a year, and every time it does, markets around the world hold their breath. Why? Because the decisions made here can influence everything from interest rates to inflation. So, buckle up because we’re about to decode the mysteries of the FOMC meeting and why you should care.

What is the FOMC Meeting Anyway?

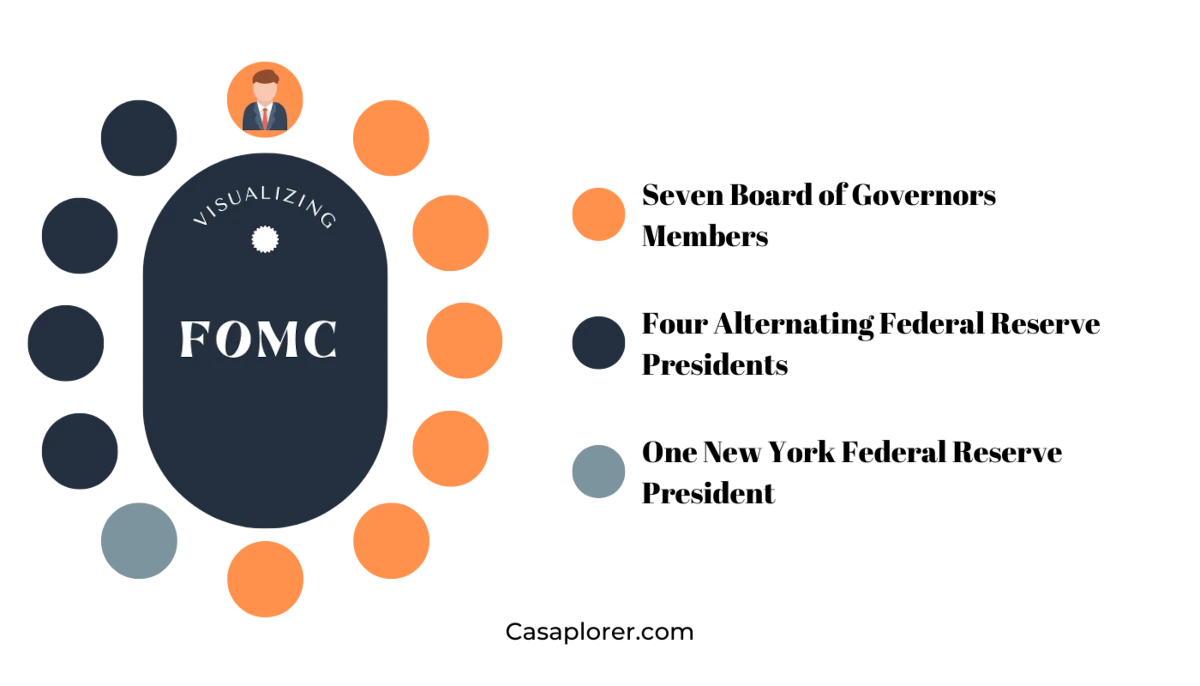

Let’s start with the basics. The FOMC meeting is like a super important gathering of the Federal Reserve’s top brass. Think of it as the economic version of a Marvel summit, where all the heroes (or in this case, economists) come together to save the day. This committee is made up of 12 members, including the Fed Chair and other key players.

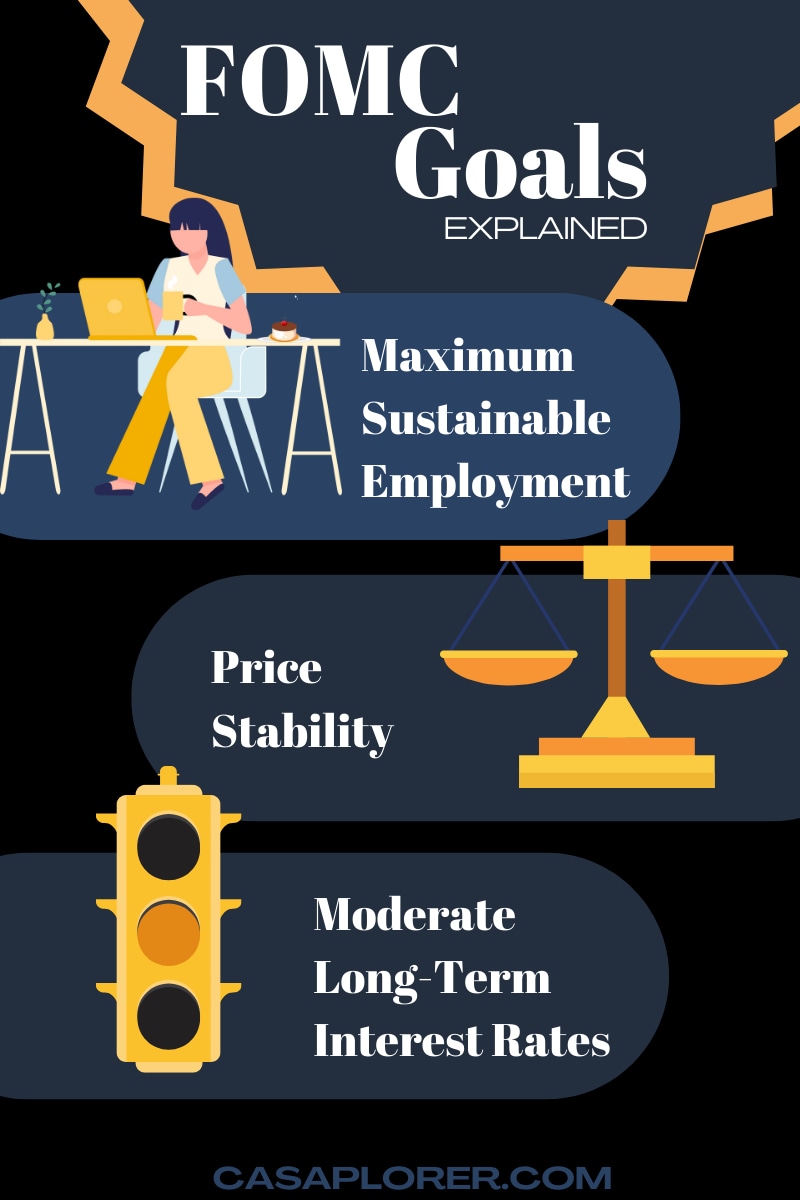

During these meetings, they discuss and decide on monetary policy, which basically means they figure out how to keep the economy running smoothly. They look at things like employment rates, inflation, and economic growth. It’s kind of like a financial check-up for the country. And just like when you visit the doctor, the outcomes can be good or bad.

Who’s Who in the FOMC?

Alright, so who are these people making all the big decisions? The FOMC is led by the Fed Chair, who’s currently Jerome Powell. Alongside him are 11 other members, including the presidents of the Federal Reserve Banks and a few governors. These guys are the real deal, folks. They’ve got years of experience and a deep understanding of how the economy works.

Each member brings their own perspective to the table, which makes for some pretty intense discussions. Think about it: you’ve got people from different parts of the country, with different economic priorities. So, when they all come together, it’s like a big melting pot of ideas.

Why Should You Care About FOMC Meetings?

Here’s the thing: even if you’re not an economist or a financial guru, the FOMC meeting affects you. Whether you realize it or not, the decisions made during these meetings can impact your wallet. For instance, if the committee decides to raise interest rates, it could mean higher costs for loans, mortgages, and credit cards. Not exactly fun news, right?

But it’s not all doom and gloom. Sometimes, they lower rates to stimulate the economy, which can lead to cheaper borrowing and more spending. So, whether you’re a business owner, a homeowner, or just someone trying to make ends meet, the FOMC meeting is something you should keep an eye on.

How Do FOMC Decisions Impact the Market?

Markets love certainty, and the FOMC meeting provides just that. When the committee announces its decisions, it gives investors a clearer picture of what to expect in the future. This can lead to increased confidence and more stable markets. However, if the decisions are unexpected or controversial, it can cause volatility and uncertainty.

For example, if the FOMC hints at a rate hike, it could cause stock prices to drop as investors anticipate higher borrowing costs. Conversely, if they signal a rate cut, it could boost stock prices as companies and consumers benefit from cheaper borrowing.

The FOMC Meeting Process

Now, let’s talk about how these meetings actually work. It’s not as straightforward as you might think. The process involves a lot of data analysis, discussions, and debates. Here’s a quick breakdown:

- Data Collection: Before the meeting, the committee gathers data on various economic indicators like employment, inflation, and GDP.

- Discussion: During the meeting, members discuss the data and its implications for the economy.

- Decision-Making: Based on the discussions, the committee votes on whether to change interest rates or maintain the status quo.

- Announcement: After the meeting, the committee releases a statement detailing its decisions and reasoning.

It’s a pretty thorough process, and it’s designed to ensure that decisions are well-informed and thoughtful.

Key Players in the FOMC Meeting

As we mentioned earlier, the FOMC is made up of 12 members, each with their own role and responsibilities. Here’s a closer look at some of the key players:

- Fed Chair: The leader of the committee, responsible for guiding discussions and making final decisions.

- Regional Fed Presidents: Represent different parts of the country and bring regional economic perspectives to the table.

- Governors: Provide a broader, national perspective and help shape the committee’s overall strategy.

Each member brings something unique to the table, which makes for a diverse and dynamic decision-making process.

The Importance of Interest Rates

Interest rates are the bread and butter of the FOMC meeting. They’re like the thermostat for the economy, helping to regulate things like inflation and growth. When the economy is overheating, the committee might raise rates to cool things down. And when it’s struggling, they might lower rates to give it a boost.

But here’s the thing: interest rates don’t just affect the economy; they also impact everyday people. If you’ve got a mortgage, a car loan, or even a savings account, the decisions made during the FOMC meeting can have a direct impact on your finances.

How Interest Rates Affect the Economy

Interest rates are like the steering wheel for the economy. They can influence everything from consumer spending to business investment. Here’s how:

- Higher Rates: Discourage borrowing and spending, which can slow down economic growth and reduce inflation.

- Lower Rates: Encourage borrowing and spending, which can stimulate economic growth and increase inflation.

It’s a delicate balancing act, and the FOMC has to be careful not to tip the scales too far in either direction.

Common Misconceptions About FOMC Meetings

There are a lot of myths and misconceptions floating around about the FOMC meeting. Let’s clear some of them up:

- Myth #1: The FOMC controls the stock market. While their decisions can influence market behavior, they don’t have direct control over stock prices.

- Myth #2: The FOMC only cares about big businesses. In reality, they consider the needs of all economic stakeholders, including consumers and small businesses.

It’s important to understand what the FOMC meeting is and isn’t, so you can make informed decisions about your finances.

How to Stay Informed About FOMC Meetings

Staying up-to-date on FOMC meetings is easier than you might think. Here are a few tips:

- Follow the News: Major news outlets like CNBC and Bloomberg provide detailed coverage of FOMC meetings.

- Read the Statements: The FOMC releases official statements after each meeting, which you can find on the Federal Reserve’s website.

- Listen to Analysts: Financial analysts often provide insights and predictions about FOMC decisions.

With a little effort, you can stay informed and make smarter financial decisions.

The Future of FOMC Meetings

As the world continues to evolve, so too does the role of the FOMC. With new challenges like climate change, technological advancements, and global pandemics, the committee has to adapt to stay relevant. This means considering a wider range of factors when making decisions and being more transparent with the public.

Looking ahead, the FOMC will likely continue to play a crucial role in shaping global economic policy. And as long as there are markets to regulate and economies to manage, these meetings will remain a vital part of the financial landscape.

What to Expect in the Coming Years

Here are a few things to watch for in the future:

- Increased Transparency: The FOMC is likely to become more open about its decision-making process.

- New Challenges: Issues like climate change and income inequality may become more prominent in discussions.

- Technological Advancements: The rise of digital currencies and fintech could impact how the committee approaches monetary policy.

It’s an exciting time to be watching the FOMC, and the next few years could bring some big changes.

Final Thoughts

Alright, so there you have it: the lowdown on FOMC meetings. They might not be as exciting as a Hollywood blockbuster, but they’re just as important when it comes to shaping the world we live in. Whether you’re a seasoned investor or just someone trying to make sense of the financial world, understanding the FOMC meeting can give you a leg up.

So, the next time you hear about an FOMC meeting, don’t tune it out. Pay attention, stay informed, and use that knowledge to make better financial decisions. And remember, the economy affects us all, so it’s worth taking the time to understand how it works.

Got any questions or thoughts? Drop a comment below, and let’s keep the conversation going. And if you found this article helpful, don’t forget to share it with your friends. Knowledge is power, folks!

Table of Contents