Hey there, fellow finance enthusiasts! If you're diving into the world of economics or trading, you’ve probably stumbled across the term "FOMC." It's not just some random acronym; it's the Federal Open Market Committee, a group that plays a pivotal role in shaping the financial landscape of the United States. Think of it as the steering wheel that guides the ship of the US economy. So, buckle up as we unravel the mysteries behind FOMC and why it matters to everyone, from Wall Street traders to everyday consumers like you and me!

FOMC stands for Federal Open Market Committee, but don’t let the fancy name intimidate you. This committee is basically a group of decision-makers who determine the monetary policy of the United States. Their decisions can have far-reaching effects, influencing everything from interest rates to inflation. Whether you're an investor looking to grow your portfolio or someone just trying to understand why mortgage rates fluctuate, understanding FOMC is key to navigating the financial world.

Now, you might be wondering, "Why should I care about FOMC?" Well, imagine this: FOMC meetings are like the Super Bowl for financial markets. Traders around the globe anxiously await their announcements, and a single word from the committee can send markets soaring—or plummeting. So, whether you're a stock market guru or just someone curious about how the economy works, this article will give you the lowdown on FOMC and why it’s such a big deal.

What is the FOMC?

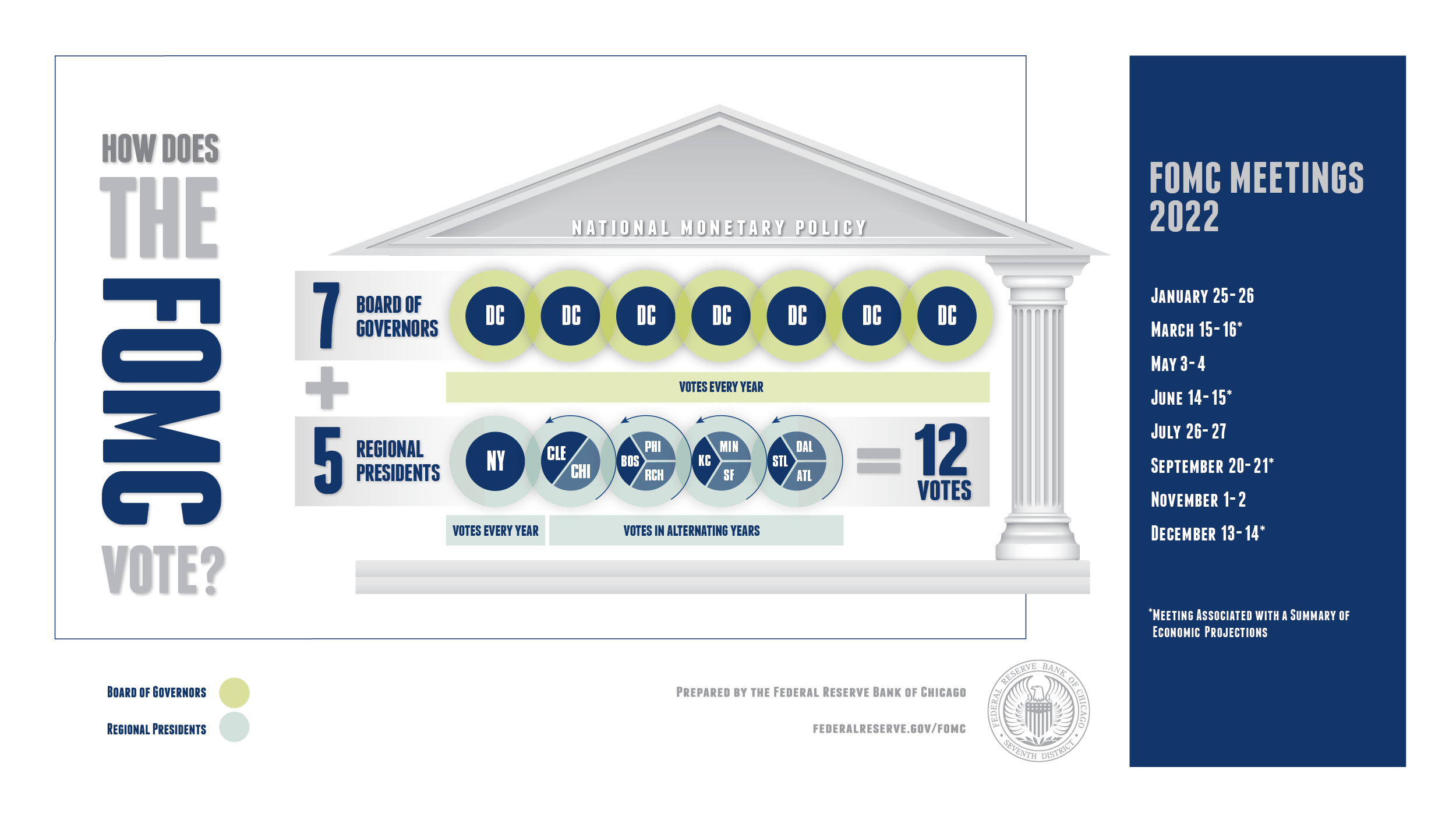

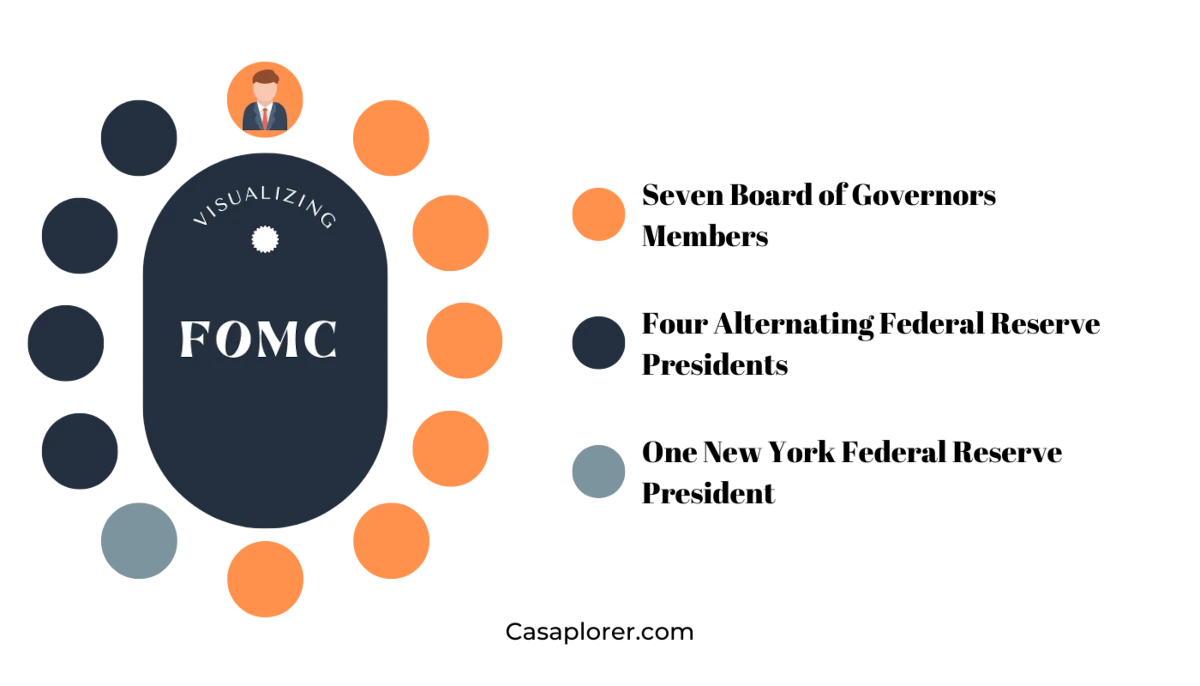

The Federal Open Market Committee, or FOMC, is essentially the brains behind the US monetary policy. It’s made up of 12 members, including the Board of Governors of the Federal Reserve System and five Reserve Bank presidents. These folks meet regularly to discuss and decide on the direction of monetary policy. They’re the ones who pull the strings when it comes to controlling inflation and promoting maximum employment.

Here’s a quick rundown of what the FOMC does:

- Sets monetary policy to ensure economic stability.

- Conducts open market operations, which involve buying and selling government securities.

- Monitors economic conditions and adjusts policies accordingly.

Their decisions have a ripple effect throughout the global economy, making them one of the most influential groups in the financial world. So, if you’re wondering who’s behind those interest rate hikes or cuts, look no further than the FOMC.

How Does the FOMC Work?

The FOMC operates through a series of meetings held throughout the year. During these meetings, members review economic data, discuss current conditions, and make decisions on monetary policy. One of their primary tools is setting the federal funds rate, which influences borrowing costs across the economy. If they decide to raise rates, borrowing becomes more expensive, which can slow down economic growth. Conversely, lowering rates can stimulate the economy by making borrowing cheaper.

Here’s a simplified version of how it works:

- Members gather economic data and analyze trends.

- They deliberate on whether to raise, lower, or maintain interest rates.

- Decisions are voted on, and the outcome is announced to the public.

It’s a meticulous process that requires a deep understanding of both domestic and global economic conditions. The FOMC doesn’t just focus on the US economy; they also consider how their decisions might impact the rest of the world. After all, in today’s interconnected global market, what happens in the US can have far-reaching consequences.

Who Makes Up the FOMC?

The FOMC is composed of 12 members, each with their own expertise and perspective. The group includes the seven members of the Board of Governors of the Federal Reserve System and five Reserve Bank presidents. The president of the Federal Reserve Bank of New York is a permanent member, while the other four spots rotate among the remaining Reserve Bank presidents.

These individuals are chosen for their knowledge of economics and their ability to make informed decisions that benefit the economy. They come from diverse backgrounds, bringing a wide range of viewpoints to the table. This diversity is crucial because it ensures that all aspects of the economy are considered when making policy decisions.

Meet the Key Players

Let’s take a closer look at some of the key players in the FOMC:

- Jerome Powell: As the Chair of the Federal Reserve, Powell plays a central role in shaping FOMC policy. His decisions often set the tone for the committee’s actions.

- John Williams: President of the Federal Reserve Bank of New York, Williams is a permanent member of the FOMC and a key player in monetary policy discussions.

- Loretta Mester: President of the Federal Reserve Bank of Cleveland, Mester is known for her hawkish stance on monetary policy, often advocating for tighter controls on inflation.

These individuals, along with the other members, work together to craft policies that promote economic stability and growth. Their expertise and experience are crucial in navigating the complex world of finance.

Why Does the FOMC Matter?

The FOMC matters because its decisions directly impact the economy. Whether you’re a business owner, an investor, or just someone trying to make ends meet, the policies set by the FOMC can affect your financial well-being. For example, if the FOMC raises interest rates, it becomes more expensive to borrow money, which can lead to higher mortgage payments, car loans, and credit card interest rates.

But it’s not all doom and gloom. The FOMC also has the power to stimulate the economy by lowering rates, making borrowing cheaper and encouraging spending. This can lead to job creation and economic growth, which benefits everyone.

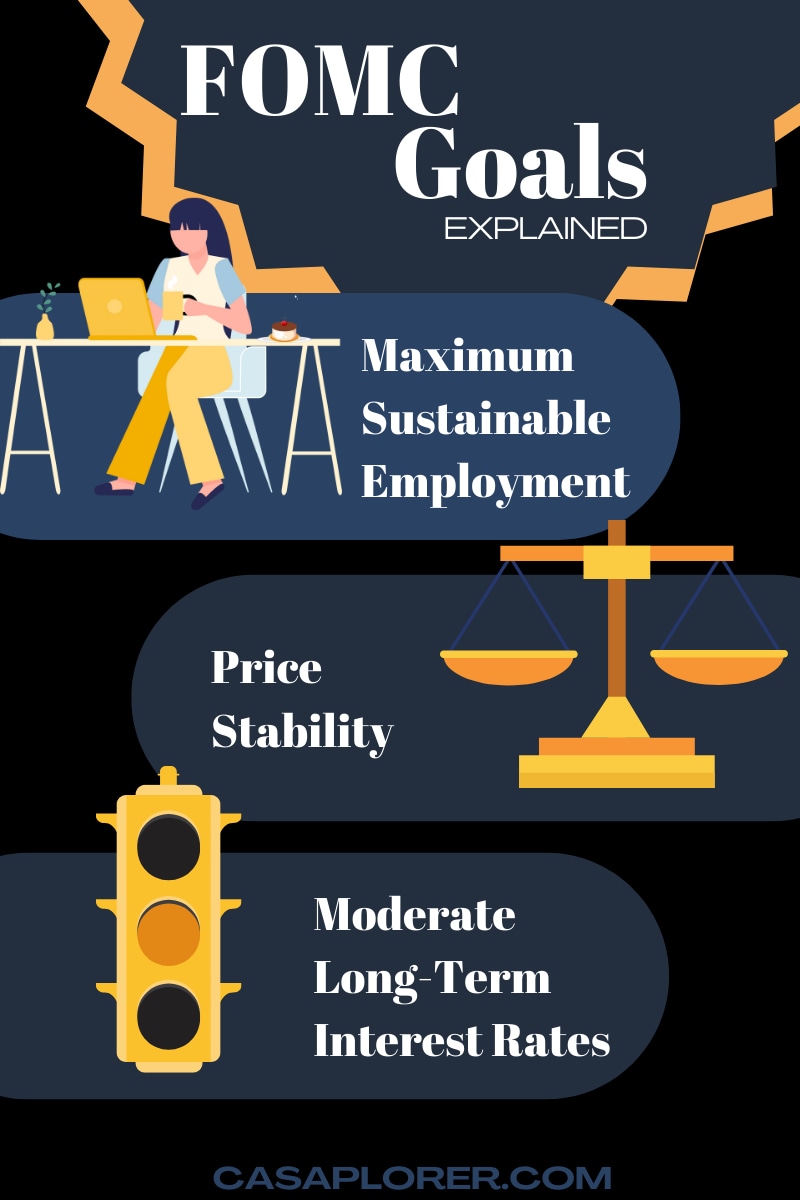

Here are a few reasons why the FOMC is so important:

- It controls inflation, ensuring that prices don’t spiral out of control.

- It promotes maximum employment, helping to reduce unemployment rates.

- It stabilizes the financial system, preventing economic crises.

So, whether you’re a seasoned investor or just someone trying to understand the economy, the FOMC is a group you need to know about.

Understanding FOMC Meetings

FOMC meetings are a big deal in the financial world. They’re held eight times a year, and each meeting is closely watched by traders, economists, and policymakers. During these meetings, members review economic data, discuss current conditions, and make decisions on monetary policy. The outcome of these meetings can have a significant impact on financial markets, which is why they’re so closely monitored.

Here’s what typically happens during an FOMC meeting:

- Members review economic data, such as employment rates, inflation, and GDP growth.

- They discuss the current state of the economy and potential risks.

- Decisions are made on whether to adjust interest rates or implement other monetary policies.

- The results are announced to the public, often followed by a press conference by the Chair of the Federal Reserve.

These meetings are crucial because they provide insight into the FOMC’s thinking and future plans. Traders and investors use this information to make informed decisions about their investments. Even everyday consumers can benefit from understanding FOMC meetings, as they can help predict future economic trends.

Impact of FOMC Decisions

The decisions made by the FOMC have far-reaching effects. They can influence everything from stock prices to mortgage rates. For example, if the FOMC raises interest rates, it becomes more expensive to borrow money, which can lead to a slowdown in economic activity. On the other hand, lowering rates can stimulate the economy by making borrowing cheaper.

Here’s a look at some of the ways FOMC decisions impact the economy:

- Interest Rates: The federal funds rate set by the FOMC influences borrowing costs across the economy.

- Inflation: The FOMC works to keep inflation in check, ensuring that prices remain stable.

- Employment: By promoting maximum employment, the FOMC helps reduce unemployment rates.

These impacts are felt not just in the US but around the world. The global economy is interconnected, and decisions made by the FOMC can have ripple effects that reach far beyond American shores.

Challenges Facing the FOMC

Like any organization, the FOMC faces its share of challenges. One of the biggest is balancing economic growth with inflation control. If the economy grows too quickly, it can lead to inflation, which erodes purchasing power. On the other hand, if growth is too slow, it can lead to unemployment and economic stagnation.

Another challenge is navigating global economic conditions. The FOMC must consider how their decisions might impact other countries, especially those with close economic ties to the US. This requires a delicate balancing act, as policies that benefit the US economy might have negative consequences elsewhere.

Here are a few of the challenges the FOMC faces:

- Managing inflation while promoting economic growth.

- Considering the impact of their decisions on the global economy.

- Dealing with unexpected economic shocks, such as pandemics or financial crises.

Despite these challenges, the FOMC continues to play a vital role in shaping the financial landscape of the United States and beyond.

How to Follow FOMC Announcements

If you’re interested in staying up-to-date with FOMC announcements, there are several ways to do so. First, you can follow the Federal Reserve’s official website, where they post meeting schedules and announcements. Additionally, many financial news outlets provide detailed coverage of FOMC meetings, offering analysis and insights into their decisions.

Here are a few tips for following FOMC announcements:

- Subscribe to financial news websites for real-time updates.

- Follow the Federal Reserve’s social media accounts for official announcements.

- Read expert analysis from economists and financial analysts to gain a deeper understanding of the FOMC’s decisions.

By staying informed, you can better understand how FOMC decisions might impact your finances and make more informed decisions about your investments and spending.

Conclusion: Why You Should Care About the FOMC

In conclusion, the FOMC plays a crucial role in shaping the financial landscape of the United States and beyond. Its decisions can have a significant impact on everything from interest rates to inflation, making it a group that everyone should be aware of. Whether you’re an investor, a business owner, or just someone trying to understand the economy, understanding the FOMC can help you make more informed decisions about your finances.

So, the next time you hear about an FOMC meeting or announcement, take a moment to pay attention. You never know how it might affect your financial future. And if you found this article helpful, don’t forget to share it with your friends and family. After all, knowledge is power, and the more we understand about the FOMC, the better equipped we are to navigate the complex world of finance.

Table of Contents