Jerome Powell, the current Chair of the Federal Reserve, has become a household name in economics and finance circles. His decisions directly impact global markets, interest rates, and the overall health of the U.S. economy. But who exactly is Jerome Powell? In this article, we’ll dive deep into his background, leadership style, and the critical role he plays in shaping monetary policy. Whether you're an investor, economist, or just someone curious about how the economy works, this article’s got you covered.

Let’s be real here—Powell isn’t just another bureaucrat sitting behind a desk. He’s at the helm of one of the most powerful institutions in the world, influencing everything from inflation rates to job creation. His decisions ripple through economies worldwide, making him a key figure worth understanding.

So, buckle up as we explore Jerome Powell’s journey, his impact on financial markets, and what his policies mean for your wallet. This ain’t just economics—it’s personal.

Table of Contents

- Biography: Who Is Jerome Powell?

- Early Life and Education

- Career Path Before the Fed

- Becoming the Federal Reserve Chair

- Jerome Powell’s Approach to Monetary Policy

- Economic Impact of Powell’s Leadership

- Key Challenges Faced by Jerome Powell

- How Powell Influences Global Markets

- The Future Outlook Under Powell

- Conclusion: Why Jerome Powell Matters

Biography: Who Is Jerome Powell?

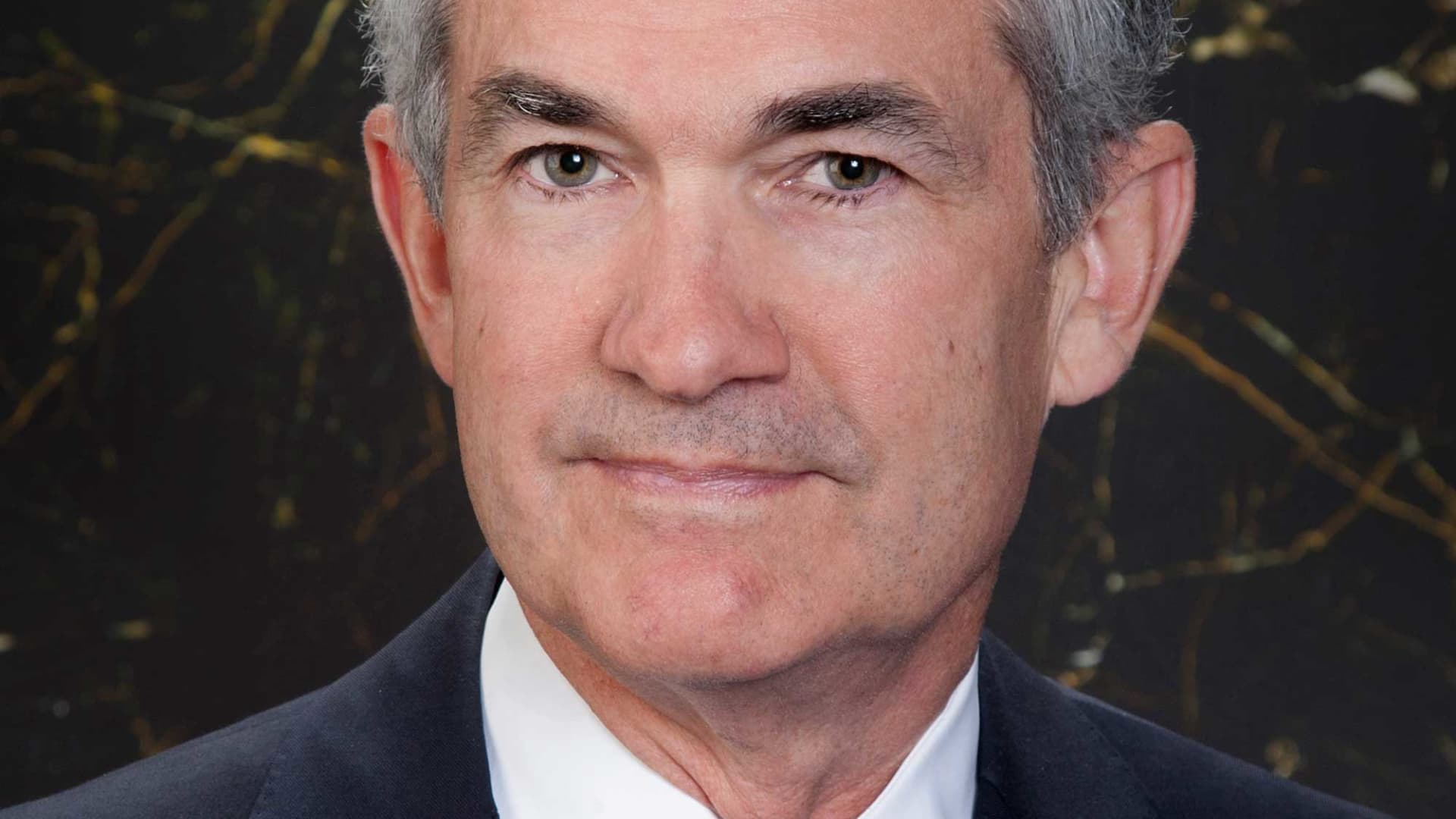

Jerome H. Powell, often referred to simply as "Jay," is the 16th Chair of the Federal Reserve. Born on February 4, 1953, in Washington, D.C., Powell has spent decades navigating the complex world of finance and public service. Before taking over the Fed, he worked as a lawyer, investment banker, and government official, giving him a unique perspective on both Wall Street and Washington.

Early Life and Education

Powell’s story begins in the nation’s capital, where he grew up in a middle-class family. After graduating from George Washington University with a degree in political science, he went on to earn his law degree from Georgetown University Law Center. But here’s the thing—Powell didn’t stop there. He also attended Harvard Business School, earning an MBA in 1981, which helped shape his future career in finance.

Here’s a quick rundown of his educational journey:

- Bachelor’s Degree in Political Science – George Washington University

- Juris Doctor (JD) – Georgetown University Law Center

- MBA – Harvard Business School

Biographical Data

| Full Name | Jerome H. Powell |

|---|---|

| Date of Birth | February 4, 1953 |

| Place of Birth | Washington, D.C. |

| Education | George Washington University, Georgetown University Law Center, Harvard Business School |

| Profession | Chair of the Federal Reserve |

Career Path Before the Fed

Before joining the Federal Reserve, Powell’s career was anything but ordinary. He started out as a lawyer but soon transitioned into the world of finance, working for Dreyfus Corporation and later co-founding The Carlyle Group, a private equity firm. It wasn’t until 1990 that Powell entered the public sector, serving as Under Secretary of the Treasury for Domestic Finance under President George H. W. Bush.

His time in the Treasury Department gave him valuable experience in navigating the intersection of finance and policy. By the time he joined the Federal Reserve Board of Governors in 2012, Powell had already established himself as a seasoned financial expert with a knack for bridging the gap between Wall Street and Main Street.

Becoming the Federal Reserve Chair

On February 5, 2018, Jerome Powell officially became the Chair of the Federal Reserve, succeeding Janet Yellen. This appointment marked a significant moment in U.S. economic history, as Powell became the first Fed Chair since Alan Greenspan without a formal background in economics. But don’t let that fool ya—his extensive experience in finance and policy more than makes up for it.

Key Responsibilities as Fed Chair

As Chair, Powell oversees the Federal Open Market Committee (FOMC), which sets monetary policy for the United States. His responsibilities include:

- Setting interest rates to manage inflation and unemployment.

- Overseeing bank regulations to ensure financial stability.

- Communicating with Congress and the public about economic conditions.

It’s a big job, and Powell’s decisions can have far-reaching consequences—not just in the U.S., but around the globe.

Jerome Powell’s Approach to Monetary Policy

Powell’s approach to monetary policy can best be described as pragmatic and data-driven. Unlike some of his predecessors, he doesn’t adhere strictly to any one economic theory. Instead, he relies heavily on real-world data and economic indicators to guide his decisions.

One of his most notable moves came in 2020 when the Fed adopted a new framework for inflation targeting. Rather than aiming for a strict 2% inflation rate, the Fed now allows inflation to run slightly higher for periods of time, a strategy known as "average inflation targeting." This shift reflects Powell’s willingness to adapt to changing economic conditions.

Economic Impact of Powell’s Leadership

Under Powell’s leadership, the Federal Reserve has navigated some of the toughest economic challenges in recent history. The COVID-19 pandemic tested the resilience of global economies, and Powell’s swift response helped stabilize markets. By cutting interest rates to near zero and implementing massive bond-buying programs, the Fed injected much-needed liquidity into the economy.

But it’s not all smooth sailing. Critics argue that Powell’s policies have contributed to rising inflation and asset bubbles. However, supporters point out that his actions have kept the U.S. economy on track during uncertain times.

Key Challenges Faced by Jerome Powell

Powell’s tenure hasn’t been without its challenges. From political pressure to unexpected economic shocks, he’s had to navigate a complex landscape. Here are a few of the biggest challenges he’s faced:

- Political Pressure: As a public servant, Powell often finds himself caught between competing political interests. Balancing independence with accountability is a delicate dance.

- Inflation Concerns: With inflation reaching multi-decade highs, Powell faces intense scrutiny over his monetary policy decisions.

- Global Uncertainty: Events like the pandemic and geopolitical tensions have added layers of complexity to an already challenging role.

How Powell Influences Global Markets

What happens at the Federal Reserve doesn’t stay at the Federal Reserve. Powell’s decisions have ripple effects across global markets. For example, changes in U.S. interest rates can influence currency values, capital flows, and even economic growth in other countries.

Investors around the world closely watch Powell’s speeches and statements for clues about future policy moves. A single phrase from his mouth can send markets soaring—or plunging. That’s the kind of power he wields.

The Future Outlook Under Powell

Looking ahead, Powell’s leadership will continue to shape the economic landscape. As the U.S. economy recovers from the pandemic, key questions remain: Will inflation remain under control? Can the Fed successfully unwind its massive stimulus programs without triggering a recession? Only time will tell.

One thing’s for sure—Powell’s legacy will be defined by how he navigates these challenges. His ability to adapt and innovate will likely determine the long-term success of his tenure.

Conclusion: Why Jerome Powell Matters

Jerome Powell may not be a household name for everyone, but his influence on the global economy is undeniable. From steering the Fed through unprecedented challenges to shaping modern monetary policy, Powell’s impact extends far beyond Washington.

So, what can you do next? Leave a comment sharing your thoughts on Powell’s leadership. Or better yet, share this article with friends who might find it interesting. Understanding the people and policies shaping our economy is more important now than ever before.

And hey, if you want to dive deeper into the world of economics and finance, check out some of our other articles. There’s always more to learn—and Powell’s story is just the beginning.