Let’s talk about XRP SEC, because this isn’t just any legal battle—it’s a clash of titans that could redefine the crypto landscape. Imagine a courtroom showdown where one side is the U.S. Securities and Exchange Commission (SEC), the financial watchdog with a reputation for cracking down on anything that smells fishy, and the other side is Ripple, the company behind XRP, which has been making waves in the blockchain space. This isn’t just about money; it’s about principles, regulations, and the future of decentralized finance. So, buckle up, because we’re diving deep into the drama that’s got the entire crypto community buzzing.

You’ve probably heard whispers about this XRP SEC saga, but let’s break it down. This case isn’t just about Ripple—it’s about setting a precedent for how cryptocurrencies will be regulated in the future. The SEC claims that Ripple sold unregistered securities by promoting XRP as an investment, while Ripple argues that XRP is a utility token, not a security. It’s like arguing whether a pineapple belongs on pizza—everyone has an opinion, and it’s getting heated.

Now, why should you care? Because this battle isn’t just about Ripple or XRP. It’s about the future of blockchain technology, the freedom of innovation, and whether regulators will stifle the growth of decentralized systems. If the SEC wins, it could mean stricter regulations for all cryptocurrencies. If Ripple wins, it might open the door for more innovation in the crypto space. Either way, this is a game-changer, and you don’t want to miss out on the details.

What Exactly is XRP SEC?

XRP SEC is shorthand for the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission. In late 2020, the SEC filed a lawsuit against Ripple, claiming that the company engaged in a $1.3 billion unregistered securities offering by selling XRP tokens. Ripple, on the other hand, insists that XRP is a utility token designed for fast, efficient cross-border payments—not a security. This disagreement has sparked debates worldwide, with crypto enthusiasts, legal experts, and regulators weighing in.

Why is This Battle Important?

This battle matters because it touches on some of the biggest questions in the crypto space:

- What defines a security versus a utility token?

- How should regulators approach decentralized technologies?

- Will this case set a precedent for future crypto regulation?

These aren’t just theoretical questions—they have real-world implications for investors, developers, and businesses in the crypto ecosystem.

The Ripple Effect: How XRP SEC is Impacting the Market

When the SEC lawsuit hit, the crypto market felt the tremors. XRP’s price plummeted, exchanges delisted the token, and Ripple’s future seemed uncertain. But here’s the thing: the crypto community didn’t just sit back and watch. Instead, they rallied behind Ripple, arguing that the SEC’s approach could stifle innovation and push blockchain development overseas. This backlash highlights the tension between regulators and the crypto industry—a tension that’s unlikely to fade anytime soon.

Key Players in the XRP SEC Drama

Let’s meet the main characters in this crypto courtroom drama:

- Ripple Labs: The company behind XRP, known for its enterprise solutions and partnerships with financial institutions.

- U.S. Securities and Exchange Commission (SEC): The regulatory body tasked with protecting investors and maintaining fair markets.

- Brad Garlinghouse: Ripple’s CEO, who has been vocal about the lawsuit and its implications for the crypto industry.

Each player brings their own perspective to the table, and their actions will shape the outcome of this battle.

Understanding XRP: Is It a Security or a Utility Token?

This is where things get technical—and controversial. The SEC argues that XRP meets the criteria of a security under the Howey Test, which determines whether an asset qualifies as an investment contract. Ripple, however, contends that XRP is a utility token designed for payments, not investment. To understand this debate, we need to dive into the nuances of blockchain technology and regulatory frameworks.

What is the Howey Test?

The Howey Test, established by the U.S. Supreme Court in 1946, defines a security as an investment of money in a common enterprise with the expectation of profit from the efforts of others. In the context of XRP SEC, the SEC claims that Ripple’s sale of XRP fits this definition. Ripple disagrees, pointing out that XRP’s primary use case is facilitating cross-border transactions, not generating profits for investors.

The Crypto Community’s Take on XRP SEC

While the SEC and Ripple duke it out in court, the crypto community is watching closely—and weighing in. Many supporters of Ripple argue that the SEC’s lawsuit is overly broad and could harm the entire crypto industry. Others, however, believe that stricter regulations are necessary to protect investors from scams and fraudulent schemes.

Why Are Crypto Enthusiasts Supporting Ripple?

Crypto enthusiasts often rally behind Ripple because they see the company as a champion of innovation. Ripple’s technology has the potential to revolutionize global payments, and many believe that the SEC’s lawsuit could stifle this progress. Additionally, Ripple’s legal team has made strong arguments in court, challenging the SEC’s interpretation of securities laws and advocating for clearer regulations.

What Could the Outcome Mean for the Crypto Industry?

The XRP SEC case has far-reaching implications for the crypto industry. If the SEC prevails, it could lead to stricter regulations for all cryptocurrencies, potentially stifling innovation and driving blockchain development to more crypto-friendly jurisdictions. On the other hand, if Ripple wins, it could set a precedent for how regulators approach utility tokens, paving the way for more decentralized projects to thrive.

Possible Scenarios and Their Impacts

Here are a few possible outcomes and their potential impacts:

- SEC Victory: Stricter regulations, increased scrutiny of crypto projects, and potential delistings of other tokens.

- Ripple Victory: Clearer guidelines for utility tokens, reduced regulatory uncertainty, and a boost for decentralized finance (DeFi) projects.

- Settlement: A middle ground where Ripple agrees to certain regulatory requirements, allowing XRP to continue operating within a defined framework.

Each scenario carries its own risks and opportunities, and the crypto industry will be watching closely to see how things unfold.

Legal Precedents and Regulatory Challenges

The XRP SEC case isn’t the first time regulators have grappled with the complexities of blockchain technology. Previous cases, such as the DAO token lawsuit and the Kik Interactive case, have set important precedents for how cryptocurrencies are classified and regulated. However, the XRP SEC battle is unique because of its scale, the prominence of the players involved, and the potential impact on the global crypto market.

Lessons from Past Cases

Looking at past cases can provide valuable insights into how regulators approach crypto-related disputes:

- The DAO Token Case: The SEC ruled that DAO tokens were securities, setting a precedent for future cases.

- Kik Interactive Case: Kik’s legal battle with the SEC ended in a settlement, highlighting the challenges of fighting regulatory agencies.

These cases underscore the importance of clear regulations and the need for crypto projects to navigate the legal landscape carefully.

Where Does the XRP SEC Case Stand Now?

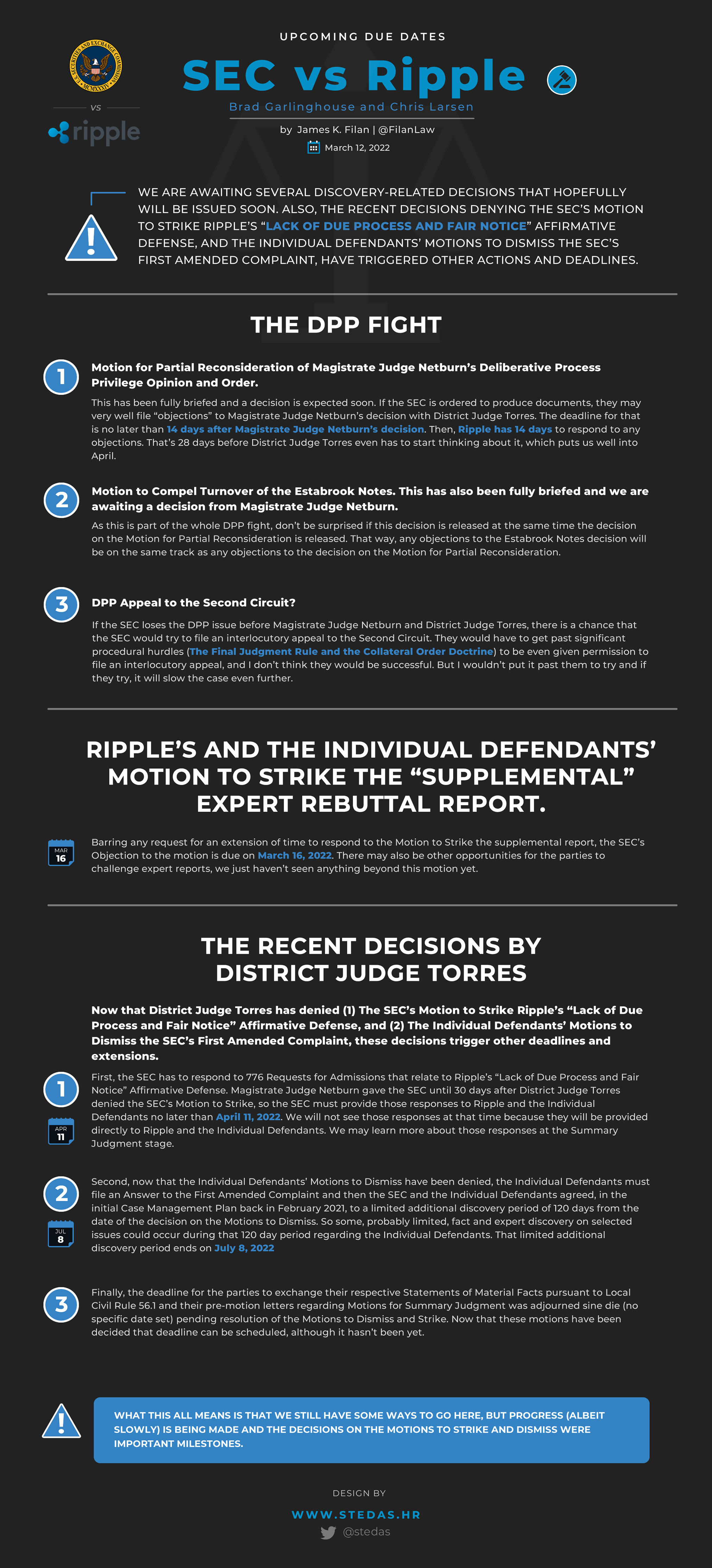

As of the latest developments, the XRP SEC case is still ongoing, with both sides presenting their arguments in court. Recent rulings have favored Ripple, with the judge dismissing some of the SEC’s claims and ordering the commission to produce internal documents related to its classification of Bitcoin and Ethereum. These developments have bolstered Ripple’s position and raised hopes among crypto enthusiasts that the company may prevail.

What’s Next for Ripple and the SEC?

The next steps in the XRP SEC case will likely involve more legal filings, court hearings, and possibly a settlement or trial. Both parties are expected to continue their efforts to sway public opinion and regulatory bodies, ensuring that this battle remains front and center in the crypto world.

Kesimpulan: What Does the Future Hold?

In conclusion, the XRP SEC case is more than just a legal dispute—it’s a defining moment for the crypto industry. The outcome of this battle will shape the regulatory landscape for years to come, influencing how cryptocurrencies are classified, marketed, and adopted. Whether Ripple wins or the SEC prevails, one thing is clear: the crypto community will continue to push the boundaries of innovation, challenging regulators to keep pace with the rapidly evolving blockchain space.

So, what can you do? Stay informed, engage in the conversation, and don’t be afraid to share your thoughts. The more voices we have advocating for clarity and fairness in crypto regulation, the better the chances of creating a balanced framework that supports both innovation and investor protection. And hey, if you found this article helpful, drop a comment or share it with your fellow crypto enthusiasts. Together, we can make a difference!

Table of Contents

- What Exactly is XRP SEC?

- The Ripple Effect: How XRP SEC is Impacting the Market

- Understanding XRP: Is It a Security or a Utility Token?

- The Crypto Community’s Take on XRP SEC

- What Could the Outcome Mean for the Crypto Industry?

- Legal Precedents and Regulatory Challenges

- Where Does the XRP SEC Case Stand Now?

- Kesimpulan: What Does the Future Hold?