Listen up, folks. The clock is ticking, and you might be leaving some serious cash on the table if you don’t act fast. If you’re one of those people who missed out on the $1,400 stimulus check from 2021, this is your last chance to claim it. Yeah, you heard me right—your last chance. So, buckle up, because we’re diving deep into what you need to know to secure that money before it’s gone forever.

Now, I know what you’re thinking. “Another deadline? Seriously?” But trust me, this one’s legit. The IRS is serious about wrapping up loose ends from the pandemic-era stimulus payments. If you didn’t get your share back then, chances are you’re still eligible—but only if you move fast. Let’s break it down step by step so you don’t miss out.

Before we dive in, let’s clear the air. This isn’t some scam or phishing attempt. It’s a real opportunity to claim money that belongs to you. And hey, who wouldn’t want an extra $1,400 in their pocket? Whether you’re saving it for a rainy day, paying off bills, or treating yourself to something nice, this cash could make a big difference. So, let’s get started.

Here’s a quick rundown of what we’ll cover in this article:

- What the $1,400 stimulus check is all about

- Why you might still qualify for it

- How to claim it before the deadline

- Important tips to avoid common mistakes

- What happens if you miss the deadline

Table of Contents

- The Background: What’s the Deal with the $1,400 Stimulus Check?

- Who’s Eligible for the Stimulus Check?

- Why Did Some People Miss Out?

- How to Claim the $1,400 Stimulus Check

- Common Mistakes to Avoid When Claiming

- Understanding the IRS Process

- The Deadline Timeline You Need to Know

- Tax Implications of Claiming the Stimulus

- What Happens If You Miss the Deadline?

- Final Thoughts: Act Now!

The Background: What’s the Deal with the $1,400 Stimulus Check?

Alright, let’s rewind a bit. Back in 2021, the U.S. government rolled out the American Rescue Plan to help Americans struggling during the pandemic. Part of that plan included a third round of stimulus checks, and for many people, that meant a sweet $1,400 deposit straight into their bank accounts. But here’s the kicker—not everyone got their money.

Some folks were overlooked, while others simply didn’t file the necessary paperwork. Maybe you were one of those people who thought, “Nah, I probably don’t qualify,” or maybe you just forgot all about it. Whatever the reason, the good news is that you can still claim that money—but only if you act fast.

Why Was the $1,400 Stimulus Check Necessary?

Let’s face it, the pandemic hit hard. Millions of Americans lost their jobs, businesses shut down, and families struggled to make ends meet. The stimulus checks were designed to provide some much-needed relief. Think of it as the government saying, “Hey, we know things are tough right now. Here’s a little something to help you out.”

But here’s the thing: the IRS doesn’t just hand out money willy-nilly. They use tax returns and other income data to determine who qualifies. If you didn’t file a tax return or if your income changed dramatically, there’s a chance you missed out. And that’s where we come in—to help you figure out if you’re still eligible and how to claim your cash.

Who’s Eligible for the Stimulus Check?

So, who gets to claim this sweet $1,400? Well, it depends on a few factors. The IRS uses your adjusted gross income (AGI) from your most recent tax return to determine eligibility. Here’s a quick breakdown:

- Single Filers: If your AGI is $80,000 or less, you’re eligible for the full $1,400.

- Married Filers: If your combined AGI is $160,000 or less, you and your spouse can each claim $1,400.

- Heads of Household: If your AGI is $120,000 or less, you qualify for the full amount.

But wait, there’s more! If you have dependents, you can claim an additional $1,400 per dependent. That means if you’re a single parent with two kids and your AGI is under the limit, you could be looking at $4,200 in total. Not too shabby, right?

What If I Didn’t File Taxes in 2021?

Don’t panic if you didn’t file taxes last year. You can still claim the stimulus check by filing a 2021 tax return now. The IRS will use your most recent tax information to determine eligibility. Just make sure you include all necessary dependents and income details to ensure you get the full amount.

Why Did Some People Miss Out?

Let’s talk about why some folks didn’t get their stimulus checks in the first place. There are a few common reasons:

- No Tax Return Filed: If you didn’t file a tax return in 2020 or 2021, the IRS might not have had the info they needed to send you a check.

- Incorrect Information: Maybe the IRS had outdated or incorrect info about your address or bank account.

- Income Changes: If your income dropped significantly during the pandemic, you might have been eligible for the check but didn’t realize it.

Whatever the reason, the important thing is that you can still claim your money. But you’ve got to act fast before the deadline passes.

How to Claim the $1,400 Stimulus Check

Ready to claim your cash? Here’s what you need to do:

- Gather Your Documents: You’ll need your Social Security number, income info, and details about any dependents.

- File a 2021 Tax Return: Even if you don’t normally file taxes, you’ll need to submit a 2021 return to claim the stimulus check. You can do this online through the IRS website or with the help of a tax professional.

- Claim the Recovery Rebate Credit: On your tax return, look for the section where you can claim the Recovery Rebat Credit. This is where you’ll enter the details about your stimulus check.

Pro tip: Use direct deposit if possible. It’s faster and more secure than waiting for a paper check in the mail.

Tips for Filing Your Tax Return

Filing taxes can be a headache, but don’t let that stop you from claiming your money. Here are a few tips to make the process smoother:

- Use IRS Free File if you qualify—it’s a free service that helps you file your taxes online.

- Double-check all your info before submitting your return to avoid delays.

- Keep copies of all your documents in case you need to reference them later.

Common Mistakes to Avoid When Claiming

Now, let’s talk about some common mistakes people make when trying to claim their stimulus checks:

- Missing Deadlines: Don’t wait until the last minute to file your tax return. The IRS needs time to process everything.

- Incorrect Information: Make sure you enter all your info correctly, especially your Social Security number and bank account details.

- Forgetting Dependents: If you have dependents, make sure you include them on your tax return to claim the full amount.

By avoiding these pitfalls, you’ll increase your chances of getting your money quickly and hassle-free.

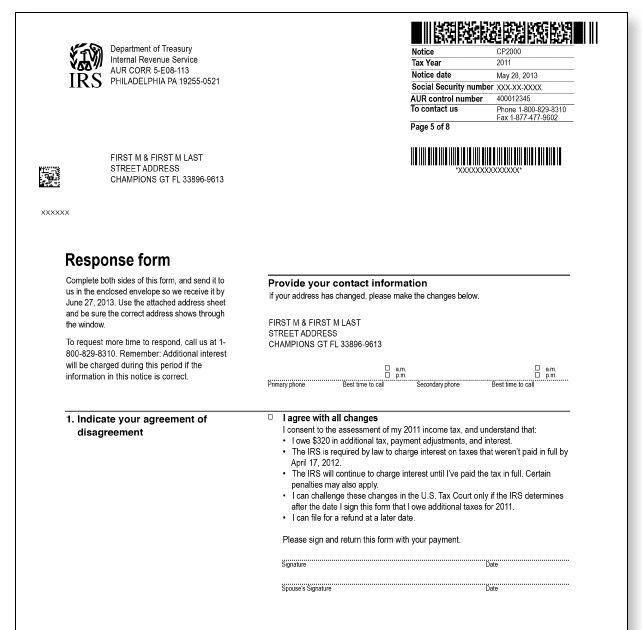

Understanding the IRS Process

Let’s take a closer look at how the IRS handles stimulus check claims. Once you file your tax return and claim the Recovery Rebate Credit, the IRS will review your info to determine if you’re eligible. If everything checks out, they’ll issue your payment either via direct deposit or a paper check.

Keep in mind that processing times can vary depending on the IRS workload and the method you choose for receiving your payment. Direct deposit usually takes about two weeks, while paper checks can take several weeks to arrive.

How Long Does It Take to Get My Money?

While there’s no exact timeline, most people who file early and use direct deposit receive their payments within a month. If you filed late or opted for a paper check, it might take a bit longer. Just be patient and keep an eye on your bank account or mailbox.

The Deadline Timeline You Need to Know

Mark your calendars, folks. The deadline for claiming the $1,400 stimulus check is fast approaching. You’ve got until October 17, 2023, to file your 2021 tax return and claim the Recovery Rebate Credit. After that, it’s game over—you won’t be able to get that money back.

So, if you haven’t already filed, now’s the time to get moving. Don’t wait until the last minute or risk missing out on thousands of dollars.

Tax Implications of Claiming the Stimulus

One question that often comes up is whether claiming the stimulus check will affect your taxes. The short answer is no. The $1,400 stimulus payments are not considered taxable income, so you won’t owe any extra taxes because of them.

However, if your income has increased significantly since 2021, you might find yourself in a higher tax bracket. That’s why it’s always a good idea to consult with a tax professional to make sure you’re fully prepared for tax season.

What Happens If You Miss the Deadline?

Let’s say you miss the October 17 deadline. What then? Unfortunately, you won’t be able to claim the $1,400 stimulus check after that. The IRS won’t issue any more payments, and you’ll lose out on that money forever.

But here’s the silver lining: if you have other unclaimed tax credits or refunds, you might still be able to claim those. So, even if you miss this deadline, it’s worth filing your taxes to see if you qualify for other benefits.

Final Thoughts: Act Now!

Alright, let’s wrap this up. The $1,400 stimulus check is still up for grabs, but only if you act fast. Don’t let this opportunity slip through your fingers. File your 2021 tax return, claim the Recovery Rebate Credit, and get the money you’re entitled to.

Remember, the deadline is October 17, 2023. If you haven’t already filed, now’s the time to get moving. And if you’re feeling overwhelmed, don’t hesitate to reach out to a tax professional for help.

So, what are you waiting for? Go ahead and claim your cash. You’ve earned it. And when you’re done, don’t forget to share this article with your friends and family so they can claim their money too. Together, we can make sure no one misses out on the financial relief they deserve.