Hey there, fellow economy enthusiasts! Ever wondered what makes the financial world tick? Well, buckle up because we're diving deep into the world of the Fed rate. It's like the heartbeat of the economy, and understanding it can give you serious insights into how money flows. Whether you're an investor, a business owner, or just someone curious about the financial landscape, the Fed rate is your golden ticket to decoding the economic maze.

Now, you might be thinking, "What exactly is this Fed rate everyone keeps talking about?" Fear not, my friend, because we're about to break it down in a way that's as easy as pie. The Federal Reserve, often referred to as the Fed, uses this rate to influence the economy. It's like the Fed's secret weapon to keep things running smoothly. From controlling inflation to managing unemployment, the Fed rate plays a pivotal role in shaping our financial future.

But why should you care? Well, the Fed rate affects everything from mortgage rates to credit card interest. It can impact your wallet more than you realize. So, whether you're saving for a dream home or trying to pay off debt, understanding the Fed rate can help you make smarter financial decisions. Stick around, and we'll uncover the mysteries of this economic powerhouse together.

What Exactly is the Fed Rate?

Alright, let's get down to brass tacks. The Fed rate, officially known as the Federal Funds Rate, is the interest rate at which banks lend reserve balances to other banks overnight. Think of it as the cost of borrowing money between banks. The Fed sets a target range for this rate, and it's one of the most powerful tools in its arsenal.

This rate isn't just some random number; it's carefully calculated based on the state of the economy. When the economy is booming, the Fed might raise the rate to prevent overheating and control inflation. On the flip side, during a downturn, they might lower it to encourage borrowing and stimulate growth. It's like a financial thermostat, keeping things in check.

Why Does the Fed Rate Matter?

Here's the deal: the Fed rate has a ripple effect throughout the economy. It influences everything from consumer spending to business investments. When the rate is low, borrowing becomes cheaper, encouraging people to take out loans for big-ticket items like houses and cars. Businesses also benefit from lower borrowing costs, allowing them to expand and hire more workers.

However, when the rate is high, borrowing becomes more expensive. This can slow down spending and investment, which might not sound great, but it helps prevent the economy from spiraling out of control. It's all about finding the right balance to ensure sustainable growth.

How Does the Fed Rate Impact You?

Let's talk about the real-world implications of the Fed rate. If you're a homeowner or planning to buy a home, the Fed rate can significantly affect your mortgage rates. A lower Fed rate usually means lower mortgage rates, making it more affordable to buy a home. On the other hand, if the Fed raises the rate, you might see your mortgage payments go up.

Credit card users, listen up! The Fed rate directly impacts the interest rates on your credit cards. When the Fed rate increases, you can expect to pay more in interest on your credit card balances. So, if you're carrying a balance, it might be wise to pay it off sooner rather than later.

Investors, Take Note

Investors, the Fed rate is your bread and butter. It can influence stock prices, bond yields, and even the value of the dollar. When the Fed lowers the rate, it often leads to a rise in stock prices as companies benefit from cheaper borrowing costs. Conversely, a rate hike can cause stock prices to dip as borrowing becomes more expensive.

Bond investors also need to keep an eye on the Fed rate. When rates rise, existing bonds with lower yields become less attractive, causing their prices to fall. It's a delicate dance, and understanding the Fed rate can help you make informed investment decisions.

Historical Trends of the Fed Rate

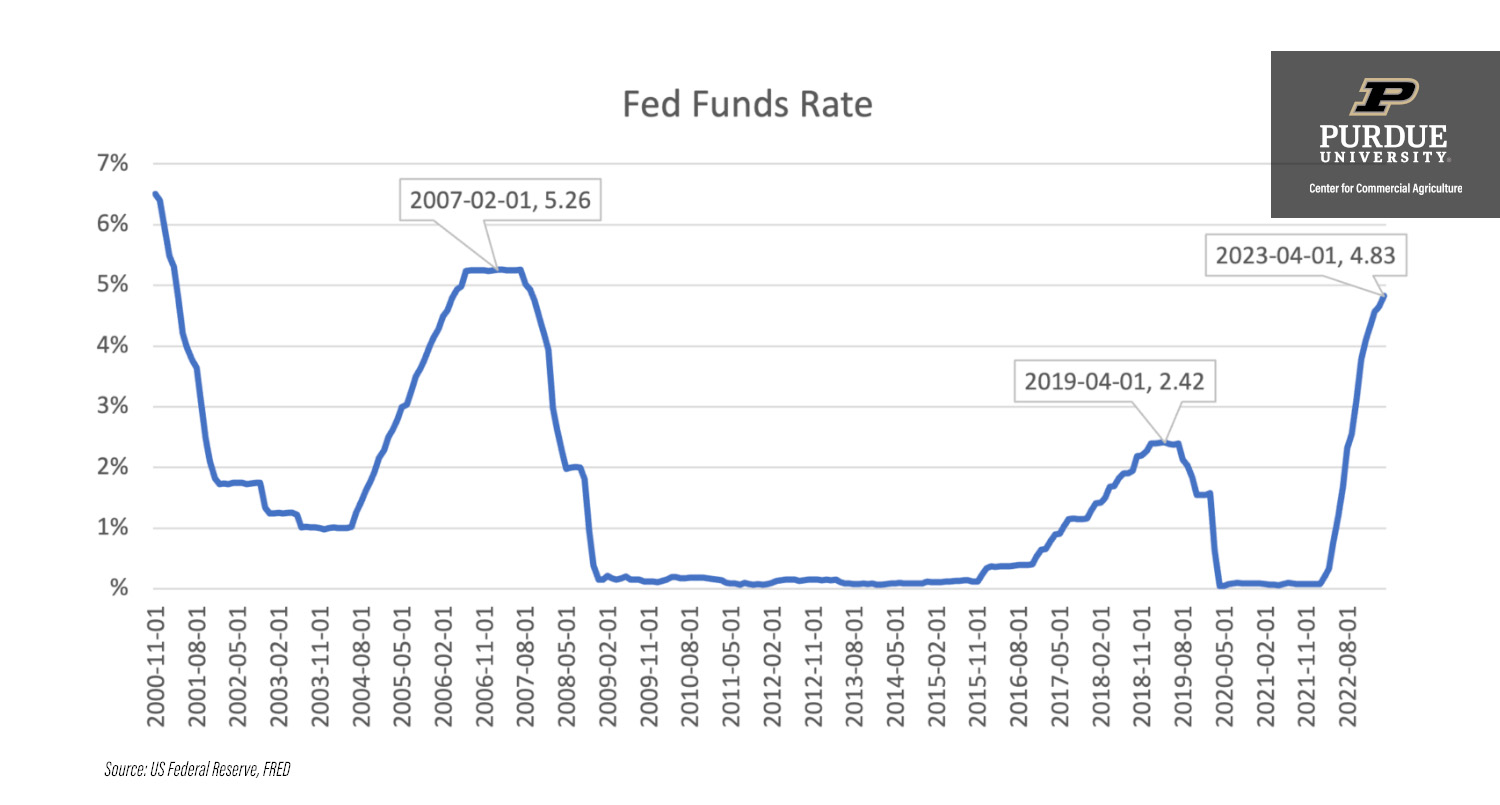

Let's take a trip down memory lane and explore the historical trends of the Fed rate. Over the years, the Fed has adjusted the rate to respond to various economic conditions. During the 2008 financial crisis, the Fed slashed the rate to near zero to stimulate the economy. It stayed there for several years until the economy showed signs of recovery.

In the early 2000s, the Fed raised rates to combat inflation, but this led to a housing market bubble that eventually burst, triggering the financial crisis. These historical trends highlight the importance of the Fed rate in shaping the economic landscape.

What Can We Learn from the Past?

History has taught us that the Fed rate is a powerful tool, but it must be used with caution. Sudden or drastic changes can have unintended consequences, as seen in the 2008 crisis. The Fed must carefully consider the broader economic context when making rate decisions. It's a balancing act that requires a deep understanding of the economy.

How the Fed Decides on Rate Changes

Ever wondered how the Fed decides when to raise or lower the rate? It's not just a random decision; it's based on a wide range of economic indicators. The Fed looks at employment data, inflation rates, consumer spending, and more to gauge the health of the economy.

One of the key indicators is the unemployment rate. If unemployment is high, the Fed might lower the rate to encourage hiring. On the flip side, if inflation is rising too fast, the Fed might raise the rate to bring it under control. It's a complex process that involves analyzing vast amounts of data and forecasting future trends.

Key Indicators the Fed Watches

- Unemployment Rate: A low unemployment rate signals a strong economy, but it can also lead to inflation if wages rise too quickly.

- Inflation: The Fed aims to keep inflation around 2%, and it uses the Fed rate to achieve this target.

- Consumer Spending: Strong consumer spending indicates a healthy economy, but excessive spending can lead to inflation.

- GDP Growth: The Fed looks at GDP growth to assess the overall health of the economy.

The Global Impact of the Fed Rate

The Fed rate doesn't just affect the U.S. economy; it has global implications as well. Since the U.S. dollar is the world's reserve currency, changes in the Fed rate can impact currency exchange rates worldwide. When the Fed raises rates, the dollar tends to strengthen, making it more expensive for other countries to borrow in dollars.

This can lead to capital outflows from emerging markets, as investors seek higher returns in the U.S. Conversely, when the Fed lowers rates, it can lead to a weaker dollar, making it cheaper for other countries to borrow. It's a global game of financial chess, and the Fed rate is one of the key pieces.

How Emerging Markets Are Affected

Emerging markets are particularly sensitive to changes in the Fed rate. A stronger dollar can make it harder for these countries to repay their dollar-denominated debts. This can lead to financial instability and even currency crises in some cases. It's a reminder that the Fed rate has far-reaching consequences beyond U.S. borders.

Tools and Strategies to Manage the Fed Rate

The Fed employs a variety of tools and strategies to manage the Fed rate. One of the most important is open market operations, where the Fed buys or sells government securities to influence the money supply. By increasing or decreasing the money supply, the Fed can influence the Fed rate.

Another tool is forward guidance, where the Fed communicates its future policy intentions to influence market expectations. This can help stabilize the economy by providing clarity and reducing uncertainty. The Fed also uses reserve requirements and discount rate policies to manage the Fed rate effectively.

Why Communication Matters

Effective communication is crucial for the Fed's success. By clearly explaining its policy decisions and future plans, the Fed can influence market behavior and stabilize the economy. Transparency builds trust, and trust is essential for the Fed's credibility. It's all about managing expectations and ensuring that everyone is on the same page.

Challenges Facing the Fed

Despite its powerful tools, the Fed faces numerous challenges in managing the Fed rate. One of the biggest challenges is the unpredictability of the global economy. Events like geopolitical tensions, natural disasters, and pandemics can throw a wrench in the Fed's plans. These external factors can make it difficult to forecast economic trends and make informed decisions.

Another challenge is the increasing complexity of the financial system. With the rise of fintech and digital currencies, the traditional banking system is evolving rapidly. The Fed must adapt to these changes while maintaining its role as the guardian of the economy.

Looking to the Future

As we look to the future, the Fed will need to continue innovating and adapting to the changing economic landscape. Whether it's addressing climate change, managing cyber risks, or navigating the rise of digital currencies, the Fed will play a crucial role in shaping the financial world. It's an exciting time to be part of the financial community, and the Fed rate will remain at the center of it all.

Conclusion: Taking Action

So, there you have it, folks. The Fed rate is a powerful tool that influences every aspect of the economy. Whether you're a homeowner, investor, or business owner, understanding the Fed rate can help you make smarter financial decisions. Keep an eye on the Fed's announcements and economic indicators to stay ahead of the curve.

Now, it's your turn to take action. Share this article with your friends and family to help them understand the importance of the Fed rate. Leave a comment below and let us know your thoughts. And don't forget to check out our other articles for more insights into the world of finance. Together, let's unlock the secrets of the economy and thrive in this ever-changing financial landscape!

Table of Contents

- What Exactly is the Fed Rate?

- Why Does the Fed Rate Matter?

- How Does the Fed Rate Impact You?

- Historical Trends of the Fed Rate

- How the Fed Decides on Rate Changes

- The Global Impact of the Fed Rate

- Tools and Strategies to Manage the Fed Rate

- Challenges Facing the Fed

- Looking to the Future

- Conclusion: Taking Action