Ever wondered why the stock market goes wild whenever the Federal Reserve announces something? Well, buckle up because we're diving deep into the world of the FOMC meeting. It's like a secret club that decides the fate of your investments, interest rates, and basically your financial future. So, if you're looking to stay ahead of the curve, this is where it all begins.

Now, let's get real for a sec. The FOMC meeting isn't just some random gathering of economists. It's a big deal. Think of it as the financial version of the Oscars, but instead of awards, they're deciding the direction of the economy. If you're into investing, trading, or just trying to understand why your mortgage rate keeps changing, this is your golden ticket to knowledge.

Before we dive into the nitty-gritty, let me set the stage for you. The FOMC meeting is where the Federal Open Market Committee discusses and decides on monetary policy. This is the group that controls interest rates, which means they have a direct impact on everything from your savings account to the stock market. So, yeah, it's a pretty big deal.

What Exactly is the FOMC Meeting?

Okay, so the FOMC meeting is essentially a pow-wow of the Federal Reserve's top dogs. These are the folks who are in charge of making sure the economy stays on track. They meet eight times a year, and during these meetings, they decide whether to raise, lower, or keep interest rates the same. It's like a game of financial chess, and every move they make can have ripple effects across the globe.

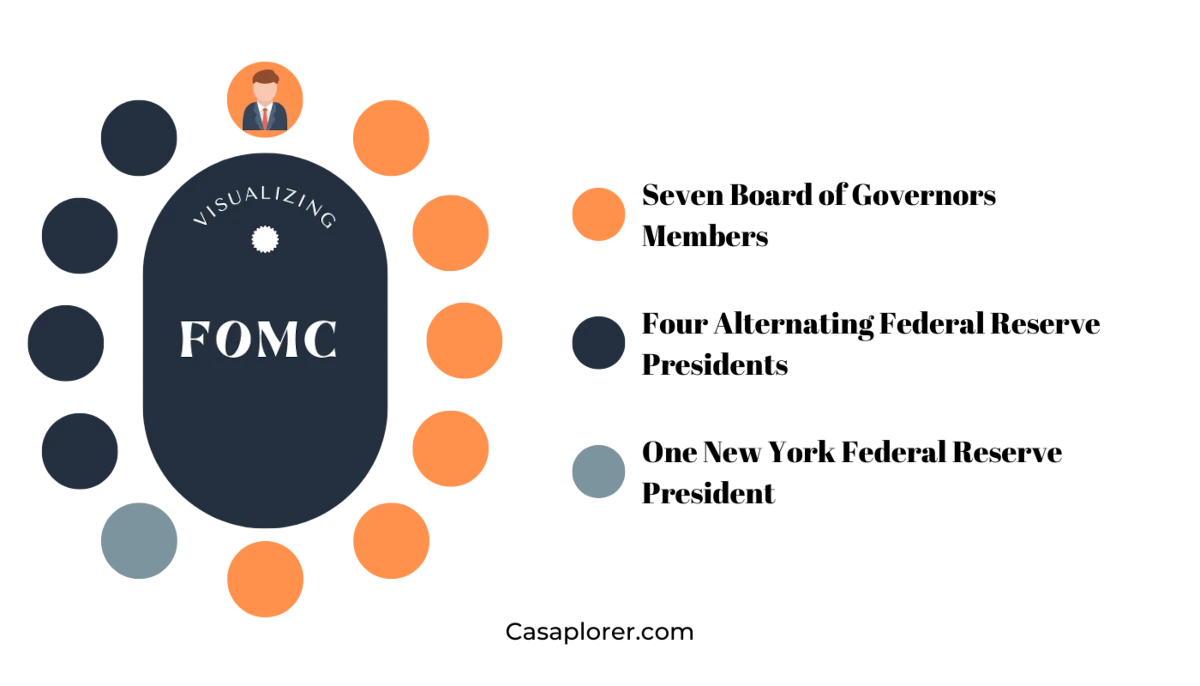

Who’s in the Room?

Let's break it down. The FOMC consists of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Federal Reserve Bank presidents. Yeah, it's a pretty exclusive club. These guys are the ones who have their fingers on the pulse of the economy, and their decisions can make or break markets.

Why Should You Care About FOMC Meeting?

Here's the thing. The FOMC meeting affects pretty much everything financial. If you're saving for a house, planning to take out a loan, or just trying to grow your investment portfolio, what happens in these meetings matters. When interest rates go up, borrowing becomes more expensive. When they go down, it becomes cheaper. Simple, right? But the implications are huge.

Impact on the Stock Market

Now, let's talk stocks. The stock market absolutely loves to react to FOMC announcements. If the committee hints at raising interest rates, you might see a dip in stock prices. Conversely, if they signal a rate cut, stocks could soar. It's like a rollercoaster ride, and the FOMC is the conductor.

How Does the FOMC Meeting Work?

Alright, so here's how it goes down. The FOMC members gather, review economic data, and discuss the current state of the economy. They look at things like inflation, unemployment rates, and GDP growth. Based on all this info, they decide on the appropriate monetary policy actions. It's not just a quick chat; these meetings can last for days.

Key Decisions Made at the FOMC Meeting

So, what exactly do they decide? The big one is the federal funds rate, which is the interest rate banks charge each other for overnight loans. This rate influences everything else. They also discuss whether to buy or sell government securities, which affects the money supply. It's like they're tweaking the economy's engine to make sure it runs smoothly.

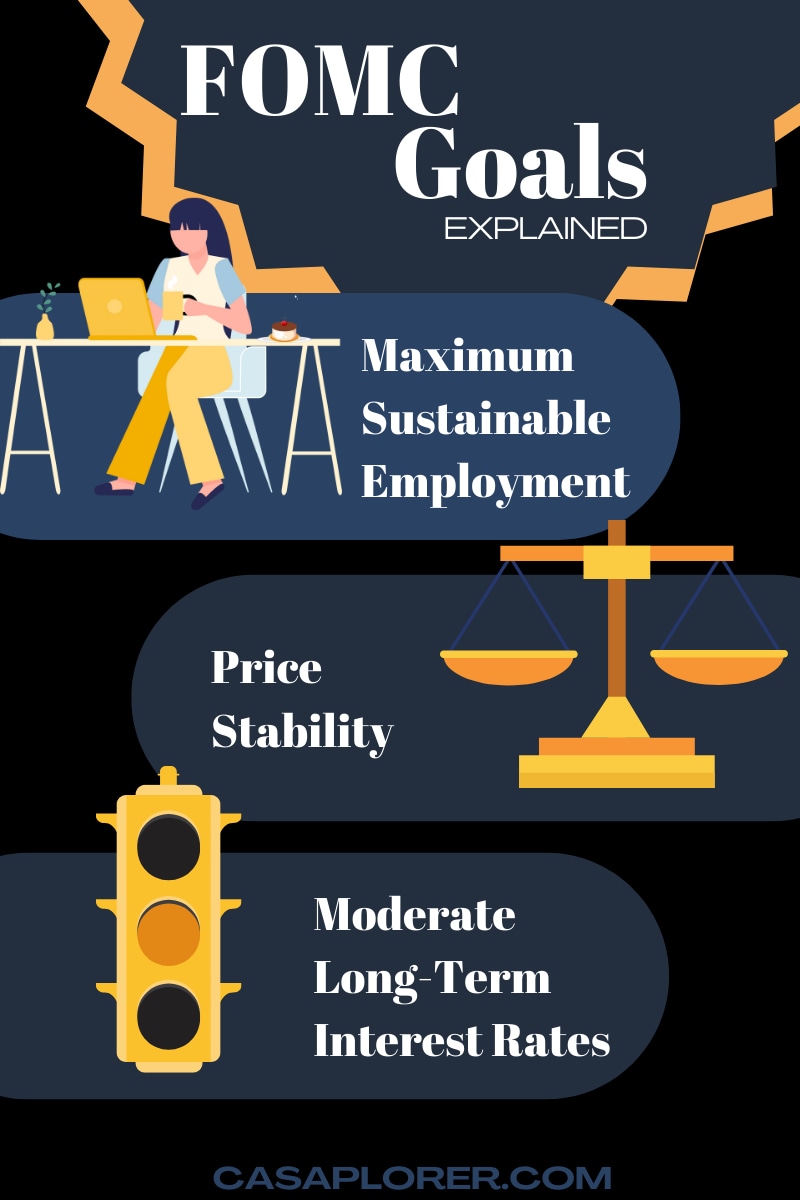

Understanding the FOMC's Role in Monetary Policy

The FOMC is all about maintaining price stability and promoting maximum employment. These are the two main goals of monetary policy. By adjusting interest rates, they can influence consumer spending, business investment, and overall economic activity. It's a delicate balancing act, and the FOMC is at the center of it all.

Tools Used by the FOMC

Here's a quick rundown of the tools the FOMC uses. First, there's open market operations, where they buy or sell government securities. Then there's the discount rate, which is the interest rate charged to commercial banks. Lastly, there's reserve requirements, which dictate how much money banks need to keep on hand. All these tools work together to steer the economy in the right direction.

Historical Significance of FOMC Meetings

Let's take a trip down memory lane. The FOMC has been around since 1933, and over the years, it's made some pretty monumental decisions. Remember the Great Recession? The FOMC played a huge role in getting the economy back on track. They slashed interest rates to near zero and implemented quantitative easing. It was a bold move, and it worked.

Key Decisions in Recent Years

Fast forward to recent years, and the FOMC has continued to make waves. In response to the pandemic, they once again dropped interest rates to near zero and launched massive stimulus programs. These actions helped stabilize the economy during a time of unprecedented uncertainty. It just goes to show how crucial the FOMC is in navigating economic challenges.

How to Stay Updated on FOMC Meetings

So, how do you keep up with all the action? The good news is that the FOMC releases statements after each meeting, and these statements can give you a pretty good idea of what to expect. You can also tune into press conferences, where the Fed Chair provides more insights. It's like getting a behind-the-scenes look at the decision-making process.

Resources for Following FOMC Meetings

There are plenty of resources out there to help you stay informed. The Federal Reserve's website is a great place to start. You can also follow financial news outlets, as they often provide in-depth analysis of FOMC meetings. And if you're really into it, there are even podcasts and YouTube channels dedicated to breaking down the FOMC's decisions in layman's terms.

The Impact of FOMC Decisions on Everyday People

Let's bring it back to you. How does all this affect your everyday life? Well, if you're a homeowner, changes in interest rates can impact your mortgage payments. If you're a borrower, it can affect the cost of loans. And if you're an investor, it can influence the performance of your portfolio. So, yeah, it's kind of a big deal.

How to Prepare for FOMC Announcements

Here's the deal. If you're invested in the markets, it's a good idea to keep an eye on the FOMC calendar. You can adjust your investment strategy based on what you expect them to do. For example, if you think they're going to raise rates, you might want to reconsider taking on new debt. It's all about being proactive and informed.

Future Trends in FOMC Meetings

Looking ahead, the FOMC will continue to play a pivotal role in shaping the economy. With challenges like inflation and global economic uncertainty, their decisions will be more important than ever. They'll need to navigate these waters carefully, and it'll be fascinating to see how they adapt to new realities.

Predictions for Upcoming Meetings

While no one has a crystal ball, analysts are always making predictions about what the FOMC might do next. They look at economic indicators, geopolitical events, and other factors to try and anticipate the committee's actions. It's like a big game of financial forecasting, and it can be pretty exciting to follow.

Conclusion: Why the FOMC Meeting Matters

So, there you have it. The FOMC meeting is a crucial part of the financial landscape, and understanding it can give you a serious edge in managing your money. Whether you're a seasoned investor or just starting out, staying informed about these meetings is a smart move. So, keep an eye on the calendar, follow the news, and most importantly, take action based on what you learn.

And hey, if you found this article helpful, drop a comment below or share it with your friends. Knowledge is power, and the more people understand the FOMC, the better off we all are. Until next time, stay sharp and keep those finances in check!

Table of Contents

- What Exactly is the FOMC Meeting?

- Why Should You Care About FOMC Meeting?

- How Does the FOMC Meeting Work?

- Understanding the FOMC's Role in Monetary Policy

- Historical Significance of FOMC Meetings

- How to Stay Updated on FOMC Meetings

- The Impact of FOMC Decisions on Everyday People

- Future Trends in FOMC Meetings

- Conclusion: Why the FOMC Meeting Matters