Listen up, folks. If you've been following the financial world, you’ve probably heard the term FOMC floating around. It’s not just some random acronym; it’s the backbone of U.S. monetary policy. The Federal Open Market Committee, or FOMC, plays a crucial role in steering the American economy. So, whether you're an investor, a business owner, or just someone trying to understand how the economy works, this is something you need to know. Let’s dive in and break it down for ya.

Now, you might be thinking, "Why should I care about the FOMC?" Well, here's the deal: this committee has the power to influence everything from interest rates to employment levels. Their decisions can impact your wallet, your investments, and even the overall stability of the economy. It’s like they’re the captain of the ship, navigating through economic storms and smooth waters alike. So, yeah, you might wanna pay attention.

Let’s get one thing straight: the FOMC isn’t some secret society. It’s a group of experts who meet regularly to discuss and decide on monetary policy. These decisions can have ripple effects across the globe, not just the U.S. So, if you're into international finance or global markets, the FOMC is a big deal for you too. Stick around, and we’ll explore what this committee does, why it matters, and how it affects your life.

What Exactly is the FOMC?

Alright, let’s start with the basics. The FOMC, or Federal Open Market Committee, is essentially the decision-making arm of the Federal Reserve System. Think of it as the brains behind the operation. Established by the Banking Act of 1933, this committee is responsible for implementing monetary policy in the United States. But what does that mean exactly? Well, it means they control things like interest rates and the supply of money in the economy.

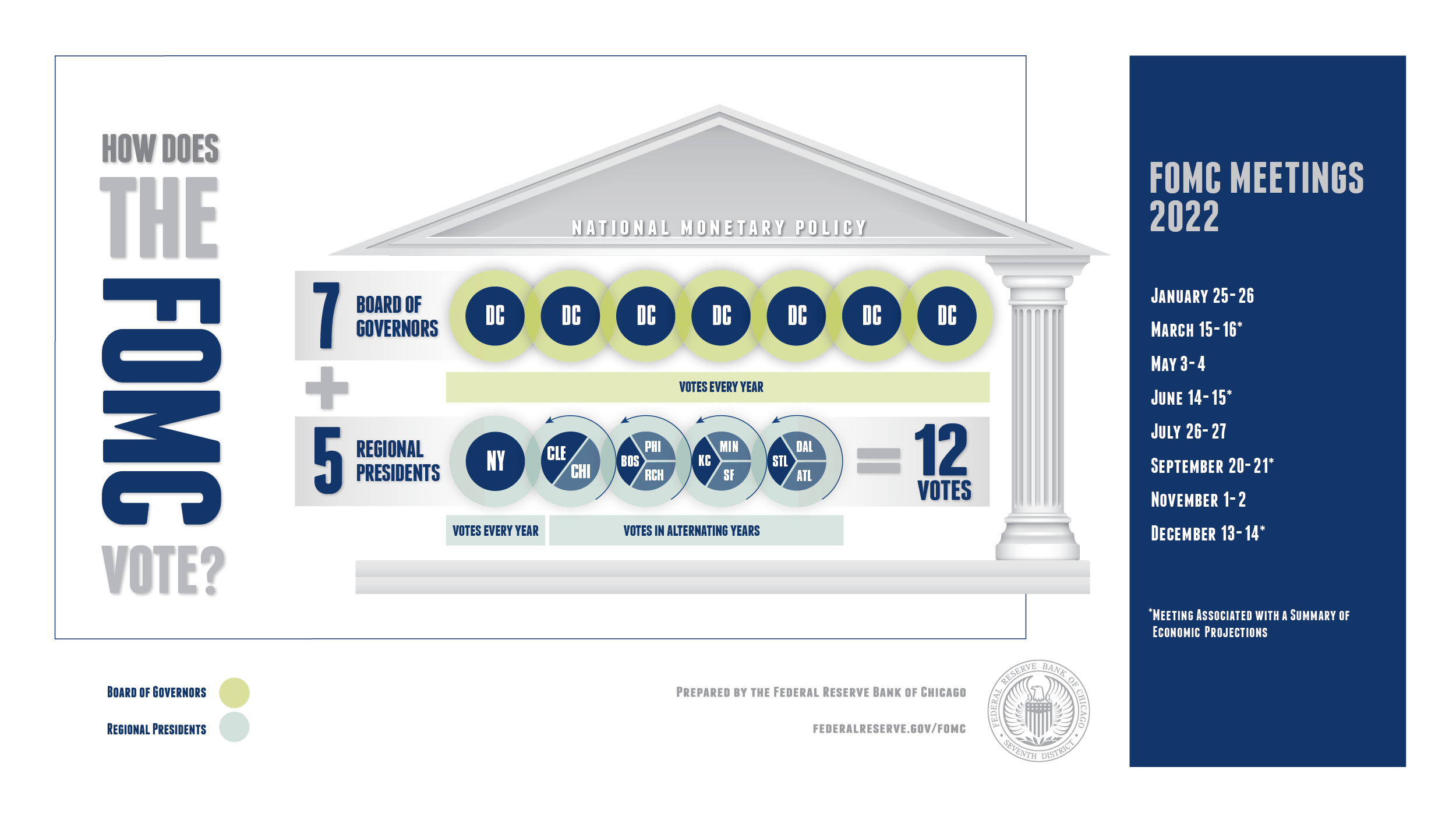

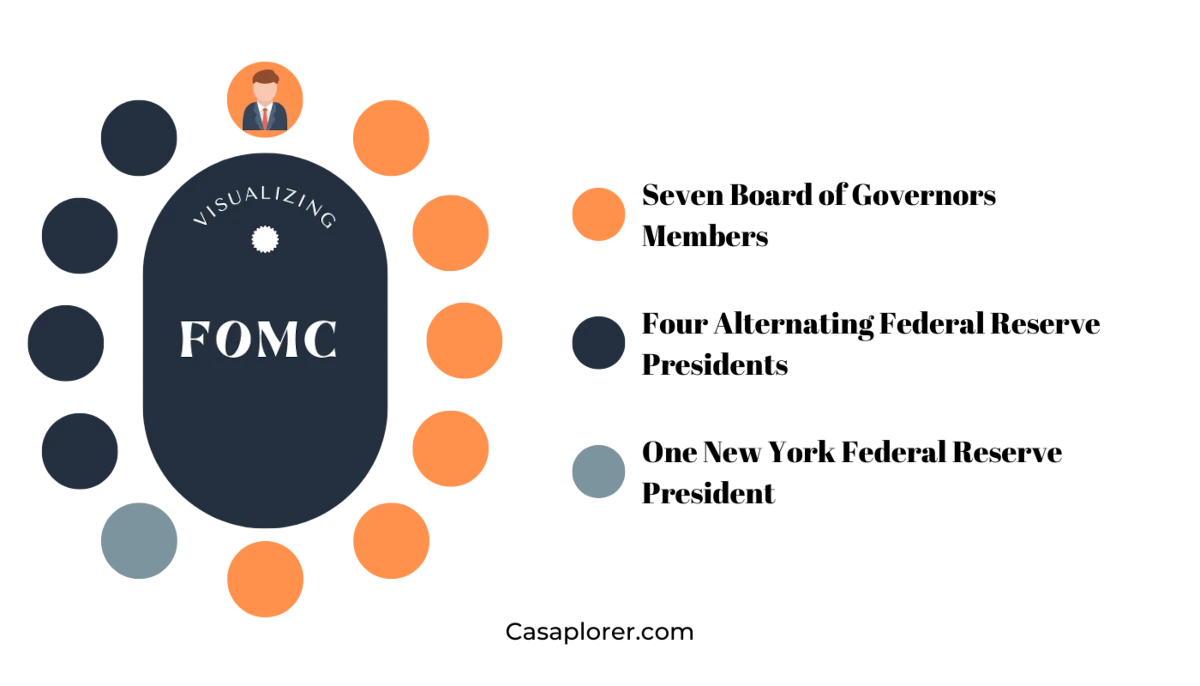

Here’s how it works: the FOMC consists of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Reserve Bank presidents. These guys meet eight times a year to assess the state of the economy and make decisions that they believe will keep things running smoothly. They’re like a team of doctors diagnosing the economy’s health and prescribing the right medicine.

Who’s on the FOMC?

So, who are these people calling the shots? The FOMC is made up of a diverse group of economic experts. The chairman of the Board of Governors, currently Jerome Powell, leads the committee. Alongside him are six other governors who serve 14-year terms. Then there are the Reserve Bank presidents, who rotate in and out of voting positions every year. This setup ensures that the committee gets a wide range of perspectives and expertise.

Now, you might be wondering, "What makes these guys so qualified?" Well, most of them have extensive backgrounds in economics, finance, and academia. They’ve spent years studying and working in the field, which gives them the knowledge and experience needed to make informed decisions. It’s like having a dream team of economic wizards at the helm.

How Does the FOMC Impact the Economy?

Let’s talk about the big question: how does the FOMC actually affect the economy? The short answer is through monetary policy. The committee uses two main tools to influence economic conditions: setting interest rates and conducting open market operations. By tweaking these tools, they can stimulate growth during downturns or cool things off when the economy is overheating.

For example, if the economy is sluggish and unemployment is high, the FOMC might lower interest rates to encourage borrowing and spending. On the flip side, if inflation is getting out of control, they might raise rates to slow things down. It’s all about finding that sweet spot where the economy is growing at a healthy pace without spiraling out of control.

The Role of Interest Rates

Interest rates are one of the FOMC’s most powerful tools. When they lower rates, it becomes cheaper for businesses and consumers to borrow money. This can lead to increased investment, spending, and hiring, which in turn boosts economic growth. Conversely, when they raise rates, borrowing becomes more expensive, which can help rein in inflation and stabilize the economy.

But here’s the thing: changing interest rates isn’t a one-size-fits-all solution. The FOMC has to carefully consider a wide range of factors, including inflation, employment levels, and global economic conditions. It’s like walking a tightrope—you have to balance all these different elements to keep things moving in the right direction.

Understanding FOMC Meetings

Okay, so we know the FOMC meets regularly to make decisions about monetary policy, but what exactly happens during those meetings? First off, they’re not just casual get-togethers. These are serious, data-driven discussions where committee members analyze economic indicators, review forecasts, and debate the best course of action.

During each meeting, the FOMC reviews a ton of information, including GDP growth, employment data, inflation rates, and financial market conditions. They also consider input from outside experts and stakeholders. After all the data has been reviewed and discussed, they vote on any changes to monetary policy. The results of these meetings can have immediate and significant impacts on financial markets, so they’re closely watched by investors and economists alike.

Key Takeaways from FOMC Meetings

- The FOMC meetings are where monetary policy decisions are made.

- They review a wide range of economic data and forecasts.

- Decisions are made through a voting process.

- Market reactions to FOMC announcements can be swift and dramatic.

The Impact on Global Markets

While the FOMC’s primary focus is on the U.S. economy, its decisions can have far-reaching effects on global markets. That’s because the U.S. dollar is the world’s reserve currency, and many countries tie their own monetary policies to the Fed’s actions. When the FOMC raises or lowers interest rates, it can influence currency values, trade balances, and investment flows around the globe.

For instance, if the FOMC raises interest rates, it can make the U.S. dollar more attractive to investors, leading to capital inflows and a stronger currency. Conversely, if they lower rates, it can weaken the dollar and impact global trade dynamics. This interconnectedness means that what happens in the U.S. can have ripple effects across the world.

How Global Markets React

Global markets tend to react quickly to FOMC announcements. Traders and investors closely monitor the committee’s statements and press conferences for clues about future policy moves. Even a subtle change in wording can send shockwaves through financial markets. It’s like a game of cat and mouse, where everyone’s trying to predict the FOMC’s next move.

But here’s the kicker: sometimes the market’s reaction isn’t always rational or proportional. Speculation and uncertainty can lead to volatility, which is why it’s important for investors to stay informed and make decisions based on facts, not fear.

FOMC and the Average Joe

Now, let’s bring it back to you, the average person. How does the FOMC’s actions affect your everyday life? Well, it depends on a few things. If you have a mortgage, car loan, or credit card, changes in interest rates can impact your monthly payments. Lower rates might mean lower payments, while higher rates could mean higher costs. It’s like a seesaw—your financial situation can go up or down depending on what the FOMC decides.

Additionally, the FOMC’s decisions can influence job availability and wage growth. If they stimulate the economy, it can lead to more job opportunities and potentially higher wages. On the flip side, if they tighten monetary policy too much, it could slow down job creation and wage growth. So, yeah, the FOMC has a pretty big impact on your wallet.

Tips for Staying Informed

- Follow FOMC meeting schedules and announcements.

- Keep an eye on interest rate trends and forecasts.

- Understand how economic indicators relate to FOMC decisions.

- Consult with financial advisors if you’re unsure about how to navigate market changes.

The Future of the FOMC

As the U.S. economy continues to evolve, so too will the role of the FOMC. With new challenges like climate change, technological advancements, and shifting demographics, the committee will need to adapt its strategies to address these issues. They’ll also have to contend with global economic uncertainties, such as trade tensions and geopolitical conflicts.

Looking ahead, the FOMC will likely continue to refine its approach to monetary policy, incorporating new data and tools to better understand and predict economic trends. This means staying flexible and open to change, which is crucial in today’s fast-paced world. It’s all about being proactive rather than reactive.

Predictions for the Next Decade

Experts predict that the FOMC will place even more emphasis on digital currencies, cybersecurity, and sustainability in the coming years. As more countries explore central bank digital currencies (CBDCs), the FOMC may need to consider how these innovations could impact monetary policy. Additionally, with increasing concerns about climate change, the committee might start factoring environmental considerations into their decision-making process.

Conclusion

So, there you have it—the lowdown on the FOMC and its role in shaping the U.S. economy. From setting interest rates to conducting open market operations, this committee has a massive impact on both domestic and global markets. Whether you’re an investor, a business owner, or just someone trying to make sense of the financial world, understanding the FOMC is key to staying informed and making smart decisions.

Here’s the bottom line: the FOMC isn’t just some obscure group of economists; they’re the ones steering the ship of the U.S. economy. By keeping an eye on their meetings, decisions, and statements, you can better prepare yourself for whatever economic conditions may arise. So, stay tuned, stay informed, and don’t be afraid to ask questions. After all, knowledge is power, and in the world of finance, power is everything.

Now, we’d love to hear from you. Do you have any thoughts or questions about the FOMC? Leave a comment below or share this article with your friends. The more we talk about these important topics, the more we can all benefit. Until next time, keep it real and keep learning!

Table of Contents

- What Exactly is the FOMC?

- Who’s on the FOMC?

- How Does the FOMC Impact the Economy?

- The Role of Interest Rates

- Understanding FOMC Meetings

- Key Takeaways from FOMC Meetings

- The Impact on Global Markets

- How Global Markets React

- FOMC and the Average Joe

- Tips for Staying Informed

- The Future of the FOMC

- Predictions for the Next Decade