When it comes to athletic footwear and apparel, Nike is more than just a brand—it’s a lifestyle. Nike stock has been the talk of the town for investors, enthusiasts, and sneakerheads alike. Whether you're looking to invest in Nike or just curious about what makes this company tick, you've come to the right place. In this article, we'll break down everything you need to know about Nike stock, from its performance to its future outlook.

Let’s be real here, Nike isn’t just some random company that sells sneakers. It’s a global powerhouse that dominates the sports apparel market. But what does owning a piece of Nike through its stock actually mean? Is it worth it? Should you jump on the bandwagon or sit this one out? We’ll answer all these questions and more.

Now, before we dive into the nitty-gritty, let’s set the stage. Nike stock isn’t just about numbers on a chart. It’s about understanding the brand’s history, its impact on culture, and how it continues to innovate in a fast-paced world. So, buckle up, because we’re about to take you on a journey through the world of Nike stock.

What is Nike Stock and Why Should You Care?

Nike stock, officially traded as NKE on the New York Stock Exchange, represents ownership in one of the most recognizable brands on the planet. When you buy Nike stock, you’re not just buying a piece of paper—you’re investing in a company that has redefined the sports industry. But why should you care about Nike stock?

First off, Nike’s influence extends far beyond the courts and tracks. The brand has built an empire by connecting with consumers on an emotional level. Its “Just Do It” slogan isn’t just marketing; it’s a philosophy that resonates with millions. This connection translates into strong financial performance, making Nike stock an attractive option for investors.

But here’s the kicker: Nike isn’t resting on its laurels. The company continues to innovate, whether it’s through cutting-edge technology in its products or expanding into new markets. This forward-thinking approach is what keeps investors excited about the future of Nike stock.

Understanding Nike’s Market Performance

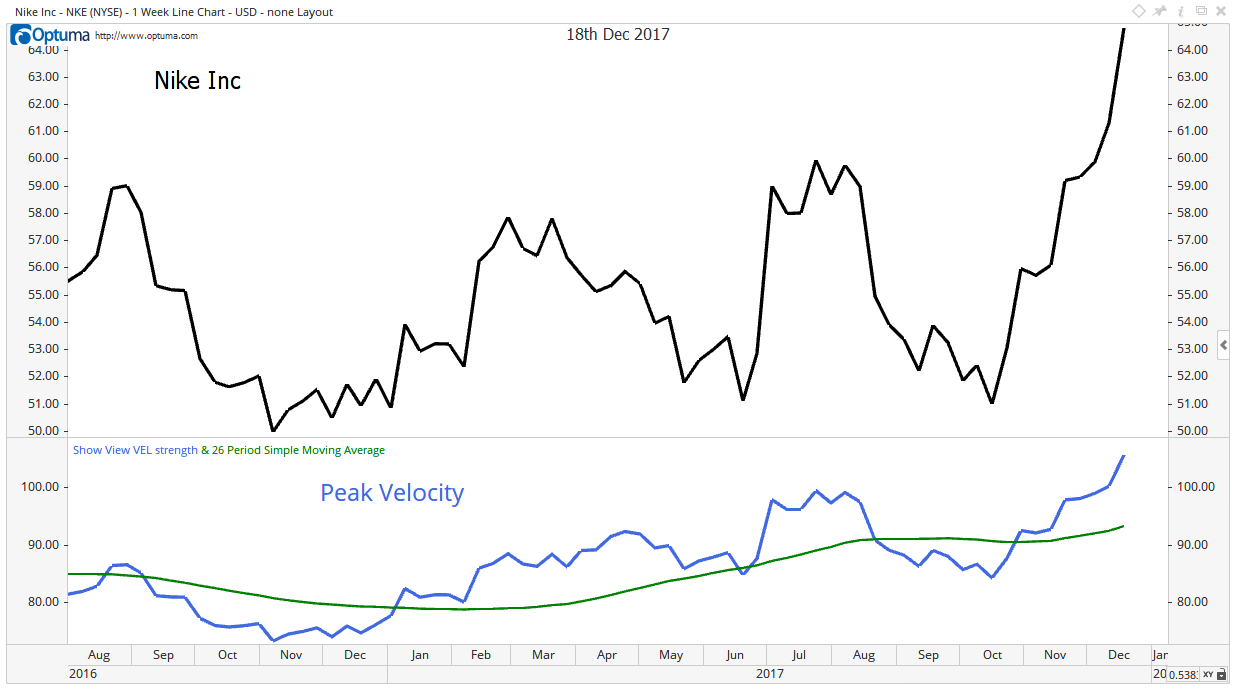

So, how has Nike stock been performing lately? Let’s break it down. Over the past few years, Nike has consistently delivered solid returns for its shareholders. Despite market fluctuations and global uncertainties, the company has managed to maintain its growth trajectory.

One of the reasons for this success is Nike’s ability to adapt. The brand has embraced digital transformation, investing heavily in e-commerce and direct-to-consumer sales. This shift has paid off, especially during the pandemic when brick-and-mortar stores were forced to close. Nike’s online sales skyrocketed, proving that the company is more than capable of navigating challenging times.

Key Financial Metrics to Watch

- Revenue Growth: Nike’s revenue has been steadily increasing, with double-digit growth in recent quarters.

- Profit Margins: The company boasts impressive profit margins, thanks to its strong brand equity and operational efficiency.

- Market Share: Nike holds a significant share of the global athletic footwear and apparel market, making it a dominant player in the industry.

These metrics paint a promising picture for Nike stock. But remember, investing isn’t just about numbers. It’s about understanding the bigger picture and the factors that drive a company’s success.

The History of Nike: A Brand Built on Passion

To truly understand Nike stock, you need to know where the company came from. Nike was founded in 1964 by Bill Bowerman and Phil Knight, two visionaries who believed in the power of sport to change lives. Back then, the company was called Blue Ribbon Sports, and its mission was simple: bring high-quality running shoes to the masses.

Fast forward to today, and Nike has become a global phenomenon. Its products are worn by athletes, celebrities, and everyday people around the world. But what sets Nike apart is its commitment to innovation and excellence. From the introduction of the Air cushioning technology to its collaborations with top designers, Nike has always been at the forefront of the industry.

Key Milestones in Nike’s Journey

- 1988: The launch of the “Just Do It” campaign, which became one of the most iconic slogans in advertising history.

- 2006: The introduction of the Nike+ platform, which revolutionized the way people track their fitness goals.

- 2020: Nike’s pivot to digital sales during the pandemic, showcasing its agility in the face of adversity.

Each of these milestones has contributed to Nike’s success and, by extension, the performance of its stock. Understanding this history gives you a deeper appreciation for what Nike stock represents.

Analysts’ Take on Nike Stock

Now, let’s talk about what the experts have to say about Nike stock. Analysts from major financial institutions have been bullish on Nike, citing its strong fundamentals and growth potential. Many believe that Nike’s focus on sustainability and innovation will continue to drive its success in the years to come.

But don’t just take our word for it. According to a report by Goldman Sachs, Nike is well-positioned to benefit from the growing demand for athletic wear and the shift towards digital commerce. This sentiment is echoed by other analysts, who see Nike as a long-term investment opportunity.

Of course, no investment is without risk. While Nike stock has performed well, there are always uncertainties in the market. That’s why it’s important to do your own research and consider factors like economic conditions, industry trends, and company-specific risks.

What the Numbers Say

Here are some key statistics to keep in mind when evaluating Nike stock:

- Market Capitalization: Nike’s market cap currently stands at over $200 billion, making it one of the largest companies in the world.

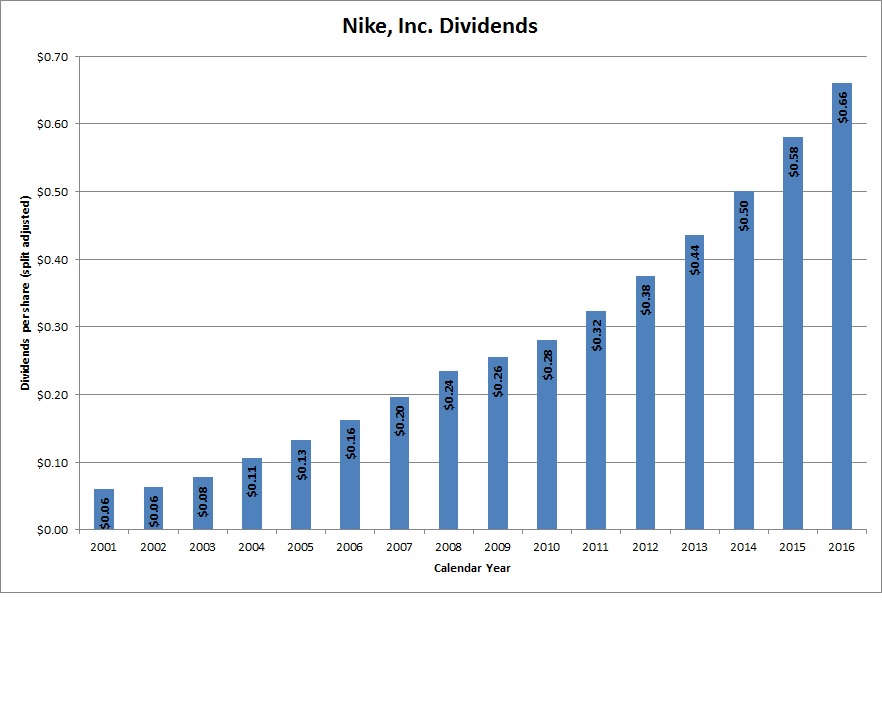

- Dividend Yield: Nike offers a modest dividend yield, making it an attractive option for income-focused investors.

- P/E Ratio: Nike’s price-to-earnings ratio is in line with industry averages, suggesting that the stock is fairly valued.

These numbers provide a snapshot of Nike’s financial health and can help you make informed decisions about whether to invest in its stock.

Factors Influencing Nike Stock Performance

Several factors can impact the performance of Nike stock. Let’s take a closer look at some of the most important ones:

Global Economic Conditions

The state of the global economy plays a significant role in determining how well Nike stock performs. Economic growth, inflation, and currency fluctuations can all affect the company’s bottom line. For example, a strong U.S. dollar can make Nike’s products more expensive in international markets, potentially impacting sales.

Consumer Trends

Consumer preferences are constantly evolving, and Nike needs to stay ahead of the curve to maintain its market position. Trends like athleisure wear, sustainability, and digital engagement are all areas where Nike is making strides. By aligning with these trends, Nike can continue to attract new customers and retain existing ones.

Competition

Nike operates in a highly competitive industry, with brands like Adidas, Puma, and Under Armour vying for market share. To stay ahead, Nike must continuously innovate and differentiate itself from its competitors. This includes investing in research and development, expanding its product offerings, and enhancing its customer experience.

Investing in Nike Stock: Is It Right for You?

Now that you have a better understanding of Nike stock, the big question remains: is it the right investment for you? The answer depends on your financial goals, risk tolerance, and investment horizon.

If you’re looking for a stable, blue-chip stock with growth potential, Nike could be a good fit. Its strong brand, diverse product lineup, and global reach make it a resilient company in uncertain times. However, if you’re more risk-averse or prefer high-growth stocks, you may want to explore other options.

Ultimately, the decision to invest in Nike stock should be based on thorough research and careful consideration of your personal circumstances. Consulting with a financial advisor can also provide valuable insights and guidance.

Tips for New Investors

- Start Small: If you’re new to investing, consider starting with a small position in Nike stock to test the waters.

- Diversify: Don’t put all your eggs in one basket. Diversify your portfolio to minimize risk and maximize returns.

- Stay Informed: Keep up with the latest news and developments related to Nike and the broader market to make informed decisions.

These tips can help you navigate the world of investing and make the most of your Nike stock experience.

The Future of Nike Stock

Looking ahead, the future of Nike stock looks bright. The company is well-positioned to capitalize on several key trends, including the rise of e-commerce, the growing demand for sustainable products, and the increasing popularity of sports and fitness.

Nike’s commitment to innovation and its ability to adapt to changing market conditions give it a competitive edge. As the company continues to expand into new markets and explore emerging technologies, the potential for growth remains strong.

Of course, there are no guarantees in the world of investing. But with its solid foundation and forward-thinking approach, Nike stock is poised to deliver value to its shareholders for years to come.

Predictions for the Next Decade

Here are some predictions for Nike’s future:

- Increased Focus on Sustainability: Nike will likely continue to prioritize eco-friendly materials and production methods.

- Expansion into New Markets: The company may explore opportunities in emerging markets, further diversifying its revenue streams.

- Enhanced Digital Presence: Nike’s investment in digital platforms and technologies will likely accelerate, offering consumers even more ways to engage with the brand.

These developments could have a significant impact on Nike stock, making it an exciting prospect for long-term investors.

Conclusion: Should You Jump on the Nike Stock Bandwagon?

In conclusion, Nike stock is a compelling investment opportunity for those looking to tap into the world of sports and fashion. Its strong brand, innovative products, and strategic focus on growth make it a standout player in the industry.

Whether you’re a seasoned investor or just starting out, Nike stock offers a chance to be part of something bigger. By doing your homework and staying informed, you can make smart decisions about whether to add Nike to your portfolio.

So, what are you waiting for? Dive into the world of Nike stock and see where it takes you. And remember, just like Nike’s famous slogan says, sometimes the best thing you can do is just do it.

Table of Contents