Listen up, folks—student loans repayment is no joke. It’s one of those things that can either keep you up at night or become a manageable part of your financial life, depending on how you approach it. If you’re reading this, chances are you’re either already knee-deep in student debt or trying to avoid drowning in it. Either way, you’re in the right place. We’re breaking down everything you need to know about repaying your student loans so you can take control of your finances and start living the life you deserve.

Let’s face it, student loans have become a reality for millions of people around the world. Whether you’re fresh out of college or years into repayment, understanding your options is key. This guide is here to simplify the process, debunk the myths, and give you actionable tips to pay off your loans without losing your mind—or your wallet.

But before we dive deep, let’s get one thing straight: student loans don’t have to ruin your life. With the right strategies, knowledge, and mindset, you can turn repayment from a headache into a stepping stone toward financial freedom. So grab your coffee, settle in, and let’s tackle this together.

Table of Contents

- Understanding Student Loans Repayment

- Types of Student Loans

- Repayment Plans Overview

- Income-Driven Repayment Plans

- Loan Consolidation and Refinancing

- Student Loan Forgiveness Programs

- Practical Tips for Repayment

- Common Mistakes to Avoid

- Financial Planning Around Student Loans

- Final Thoughts

Understanding Student Loans Repayment

Alright, let’s break it down. Student loans repayment isn’t just about sending a check every month. It’s about understanding what you owe, who you owe it to, and how long it’ll take to pay it off. Sure, it sounds simple, but trust me, there’s more to it than meets the eye.

What Exactly Are You Paying For?

Your student loan repayment isn’t just the amount you borrowed—it’s the principal plus interest. That means the longer you take to pay it off, the more you end up paying in the long run. But here’s the good news: you have options. From standard repayment plans to income-driven options, there’s a plan out there that fits your budget and lifestyle.

And let’s not forget the importance of knowing your lender. Whether it’s the federal government or a private institution, understanding who holds your loan can make a huge difference in how you approach repayment.

Types of Student Loans

Not all student loans are created equal. There are two main types: federal loans and private loans. Each comes with its own set of rules, benefits, and drawbacks.

Federal Loans

- Subsidized Loans: These are loans where the government pays the interest while you’re in school and during grace periods.

- Unsubsidized Loans: With these, the interest starts accruing as soon as the loan is disbursed.

- PLUS Loans: These are loans for parents or graduate students, often with higher interest rates.

Private Loans

Private loans, on the other hand, are offered by banks or financial institutions. They often have higher interest rates and less flexibility when it comes to repayment options. But hey, if federal loans don’t cover all your costs, private loans can help fill the gap.

Repayment Plans Overview

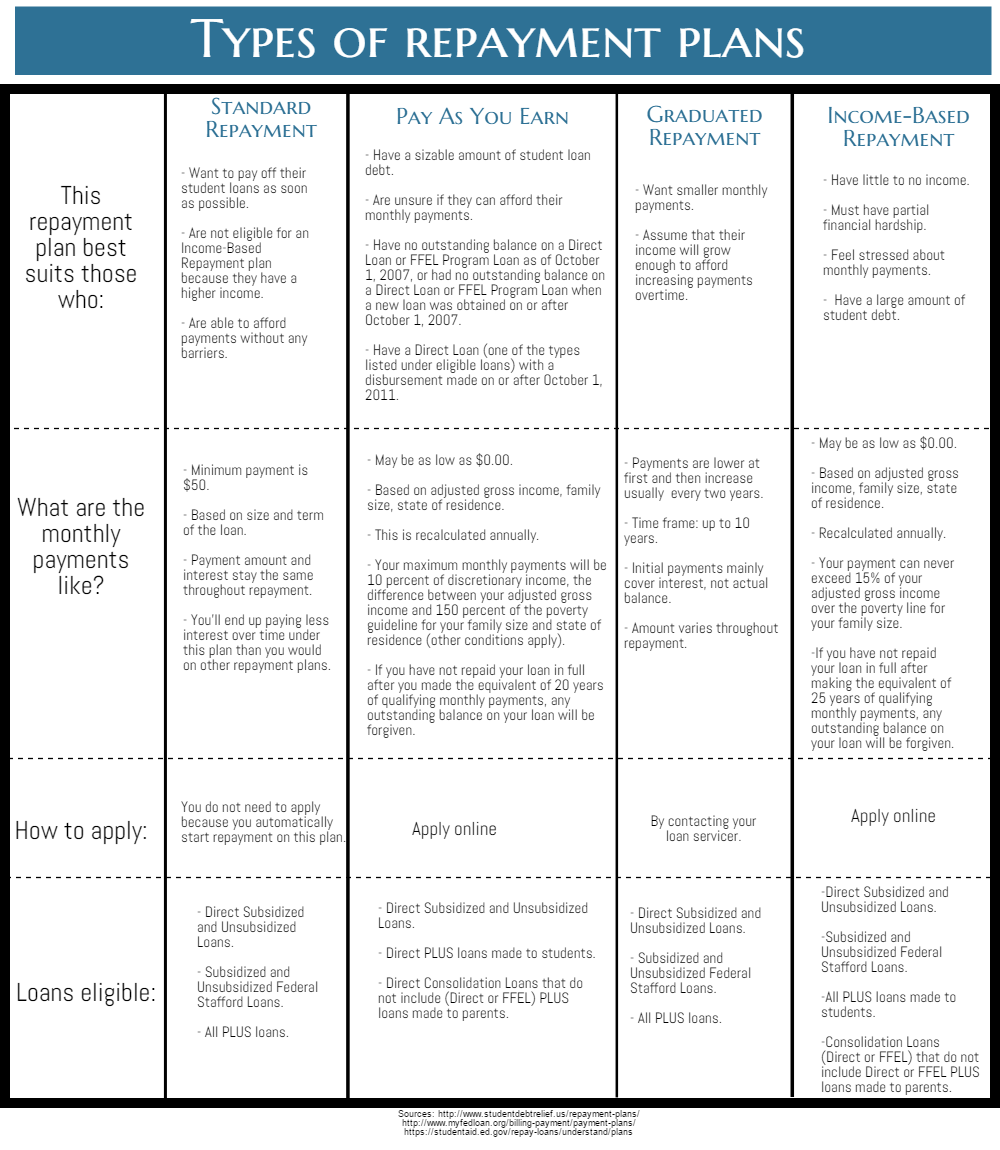

Now that you know the types of loans, let’s talk about how you pay them back. There are several repayment plans available, each designed to fit different financial situations.

The Standard Repayment Plan

This is the default plan for most federal loans. You pay a fixed amount over a 10-year period. Simple, right? But if you’re looking for flexibility, there are other options worth exploring.

Graduated Repayment

This plan starts with lower payments and gradually increases every two years. It’s great for those who expect their income to grow over time.

Income-Driven Repayment Plans

One of the most popular options for borrowers is income-driven repayment plans. These plans adjust your monthly payments based on your income and family size. Sounds pretty fair, doesn’t it?

Key Benefits

- Lower monthly payments

- Eligibility for loan forgiveness after 20-25 years

- Flexibility to adjust payments as your income changes

But remember, income-driven plans can extend the life of your loan, meaning you might pay more in interest over time. Still, for many, the short-term relief is worth it.

Loan Consolidation and Refinancing

If you’ve got multiple loans, consolidation or refinancing could be a game-changer. Let’s take a look at both.

Consolidation

Loan consolidation combines all your federal loans into one, giving you a single monthly payment. It’s like hitting the reset button on your repayment journey.

Refinancing

Refinancing, on the other hand, involves taking out a new loan with better terms to pay off your existing loans. This is usually done through a private lender. While it can lower your interest rate, you might lose some federal loan benefits in the process.

Student Loan Forgiveness Programs

Who doesn’t love the idea of having their loans forgiven? While it’s not as common as some might think, there are programs out there that can help.

Public Service Loan Forgiveness (PSLF)

If you work in public service, you might qualify for PSLF. After making 120 qualifying payments, the rest of your loan balance is forgiven. Pretty sweet deal, huh?

Teacher Loan Forgiveness

Teachers who work in low-income schools for five consecutive years can have up to $17,500 of their loans forgiven. It’s a small token of appreciation for all the hard work educators do.

Practical Tips for Repayment

Now that you’ve got the basics down, let’s talk about some practical tips to make repayment easier.

1. Set Up Automatic Payments

Automating your payments not only ensures you never miss a deadline but can also qualify you for interest rate reductions.

2. Prioritize High-Interest Loans

If you’ve got loans with varying interest rates, focus on paying off the ones with the highest rates first. This is called the avalanche method.

3. Consider Side Hustles

Whether it’s freelancing, tutoring, or driving for Uber, a side hustle can help you make extra payments toward your loans, speeding up the repayment process.

Common Mistakes to Avoid

Even the best-laid plans can go awry if you’re not careful. Here are a few mistakes to steer clear of.

1. Ignoring Your Loans

Sticking your head in the sand won’t make your loans go away. Ignoring them can lead to default, which comes with serious consequences like wage garnishment and damaged credit.

2. Missing Payments

Even if you’re struggling, missing payments should be avoided at all costs. Reach out to your lender and explore options like deferment or forbearance if you need temporary relief.

Financial Planning Around Student Loans

Student loans are just one piece of the financial puzzle. To truly take control of your finances, you need a comprehensive plan.

Create a Budget

A budget is your roadmap to financial freedom. By tracking your income and expenses, you can see exactly where your money is going and make adjustments to prioritize loan repayment.

Build an Emergency Fund

Life happens, and having an emergency fund can save you from falling behind on payments if unexpected expenses arise.

Final Thoughts

Repaying student loans isn’t easy, but it’s definitely doable. By understanding your options, avoiding common pitfalls, and staying committed to your financial goals, you can pay off your loans and move on with your life.

So, what’s next? Take a deep breath, review your loans, and start implementing the strategies we’ve discussed. And don’t forget to share this guide with anyone you know who’s tackling student loans. Together, we can make repayment less intimidating and more manageable.

Got questions or tips of your own? Drop a comment below and let’s keep the conversation going. Your financial future is worth it!